UK Growth Surges, Sterling Underpinned, FTSE 100 Prints a Fresh High

The UK economy grew by 0.6% in the first quarter of the year, driven by a 0.7% increase in services output, beating analysts’ forecasts and ending the technical recession seen last year. Nominal

GDP

is estimated to have grown by 1.2% in Q1. According to ONS chief economist Grant Fitzner, ‘ to paraphrase the former Australian Prime Minister Paul Keating, you could say the economy is going gangbusters.’

Full ONS Q1 GDP Report

For all market-moving economic data and events, see the

FB Finance Institute

Interest

rate cut

expectations were pared back marginally post-data. The first 25 basis point BoE cut is seen in August, although the June meeting remains a live event, with the second cut forecast for November.

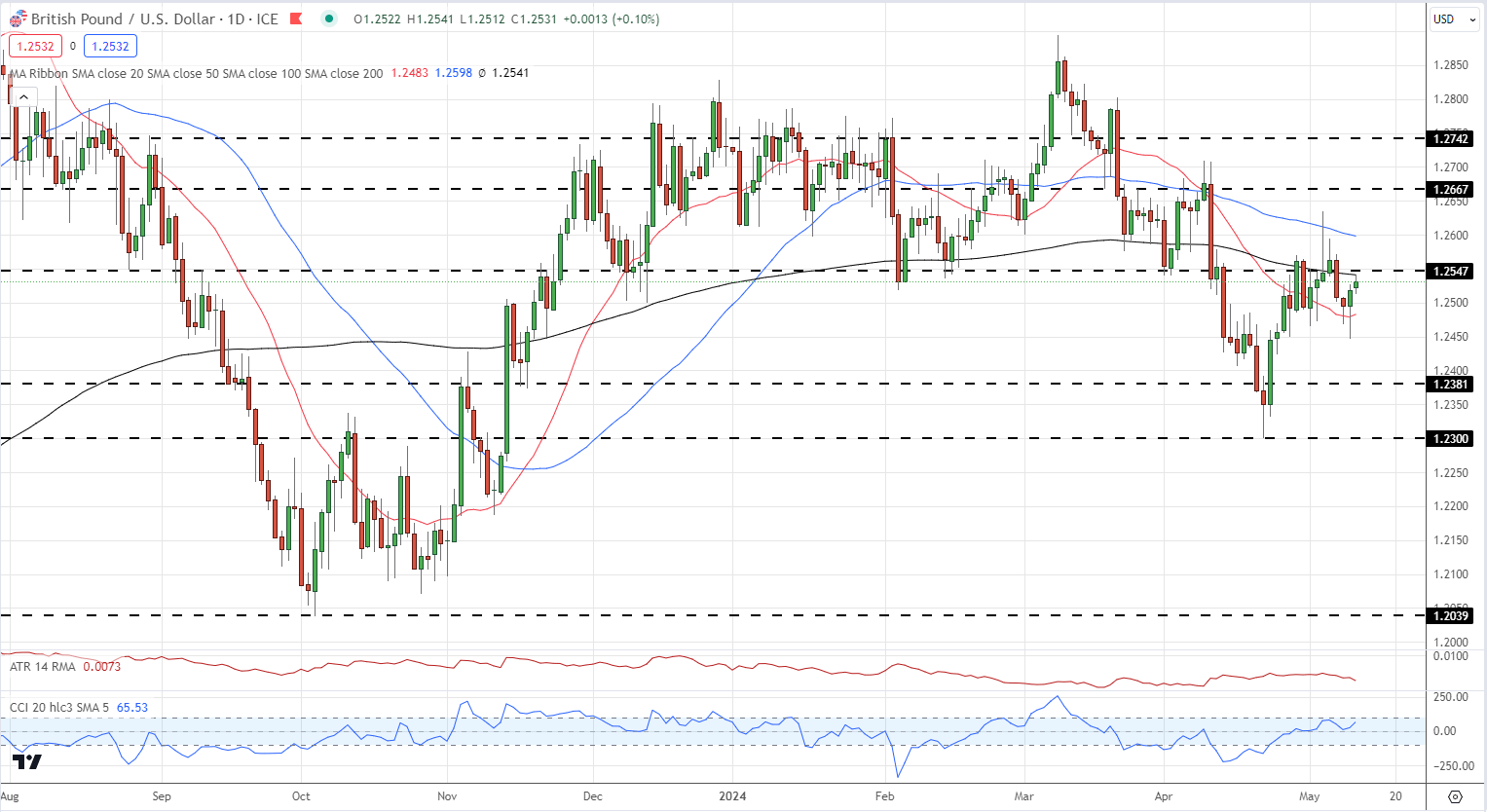

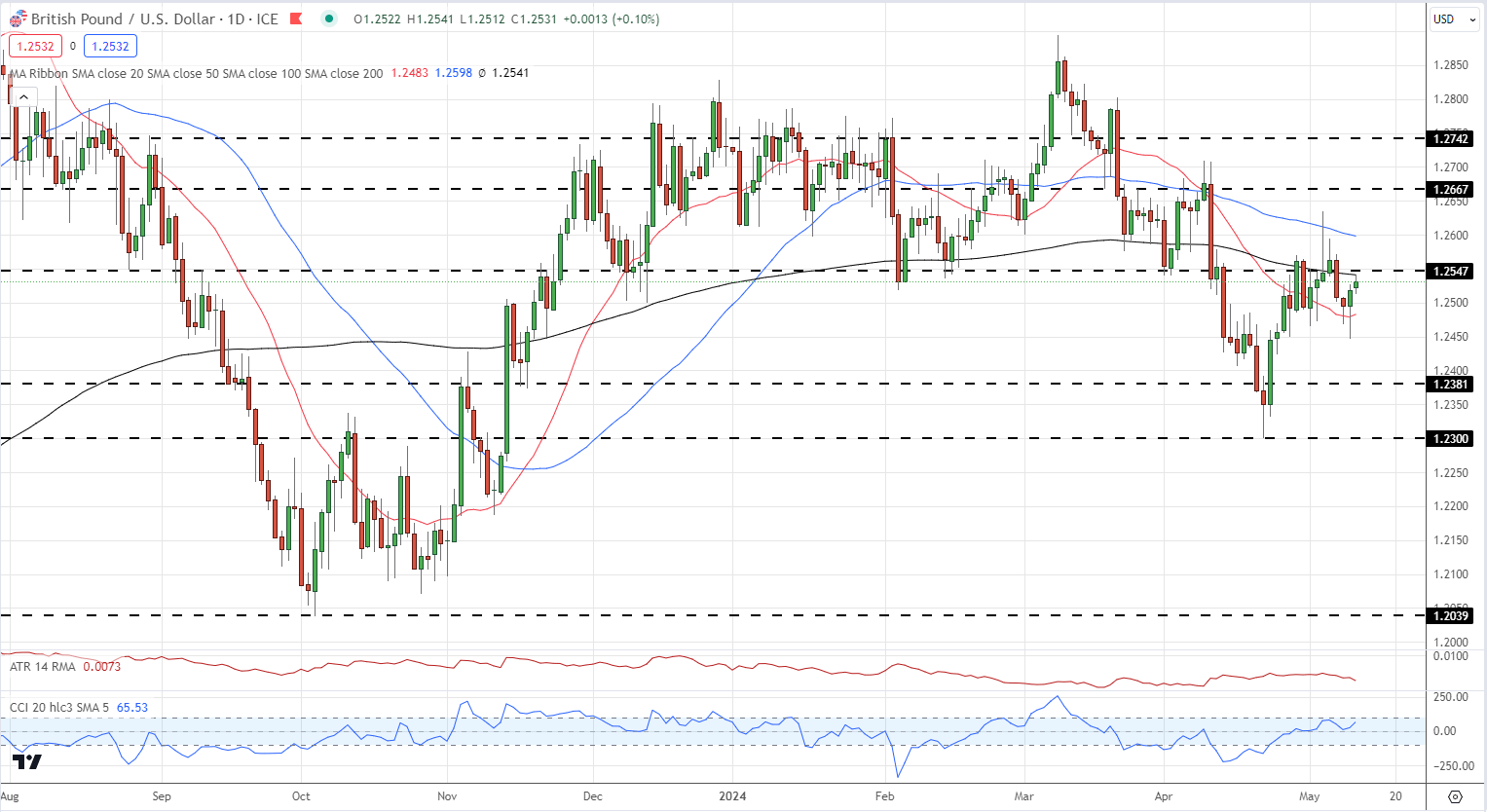

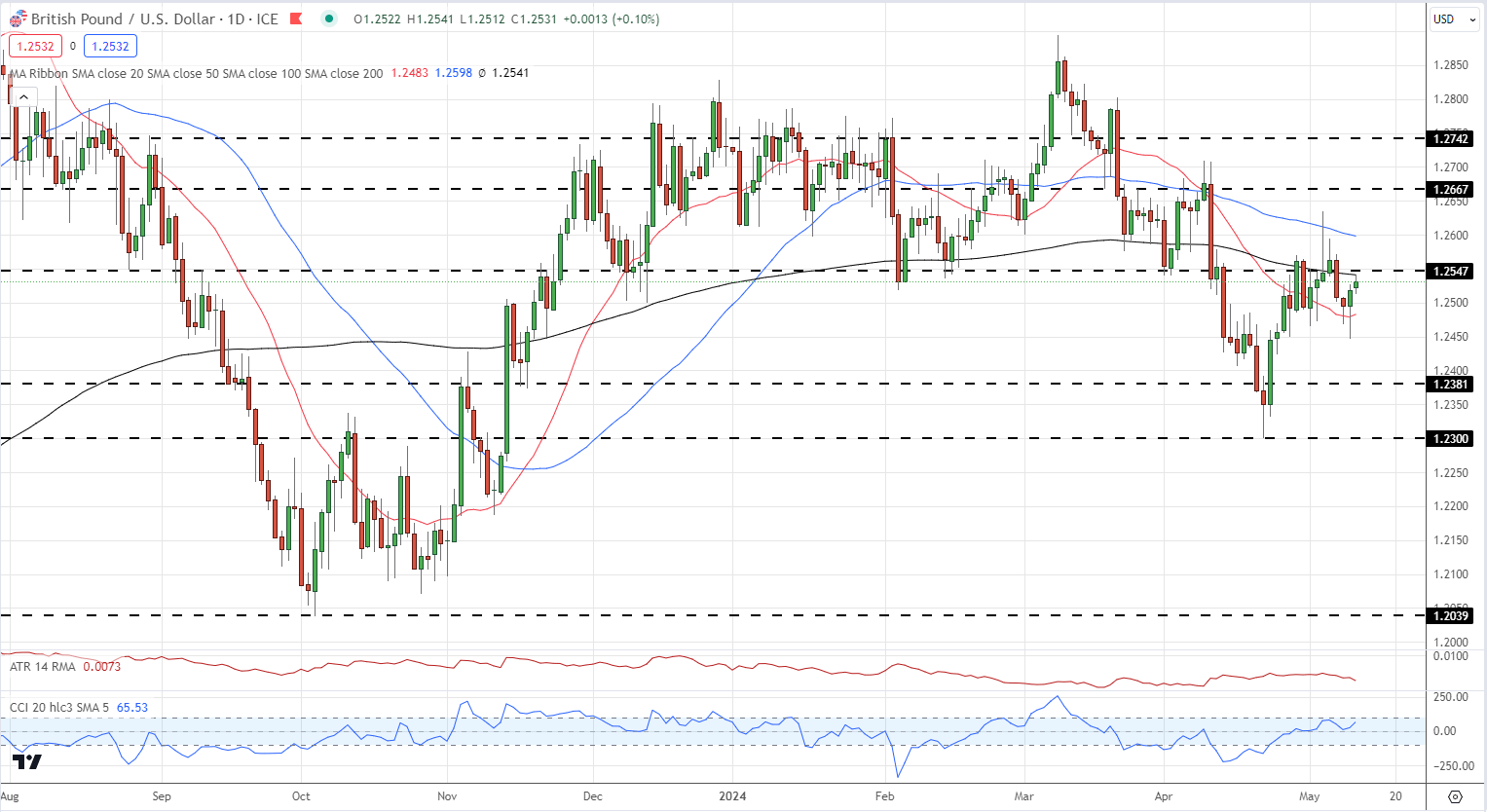

Cable (

GBP/USD

) moved slightly higher after the data release, helped in part by a weak

US dollar

. The 200-day simple moving average (1.2541) is now blocking a further higher and unless US data out later today weakens the greenback further, short-term cable upside may be limited.

IG Retail data shows 57.48% of traders are net-long with the ratio of traders long to short at 1.35 to 1.The number of traders net-long is 9.60% lower than yesterday and 19.72% higher than last week, while the number of traders net-short is 2.23% higher than yesterday and 13.42% lower than last week.

We typically take a contrarian view to crowd sentiment,

and the fact traders are net-long suggests

GBP

/

USD

prices

may continue to fall.

Download the Full Guide to See How Changes in IG Client Sentiment Can Help Your Trading Decisions

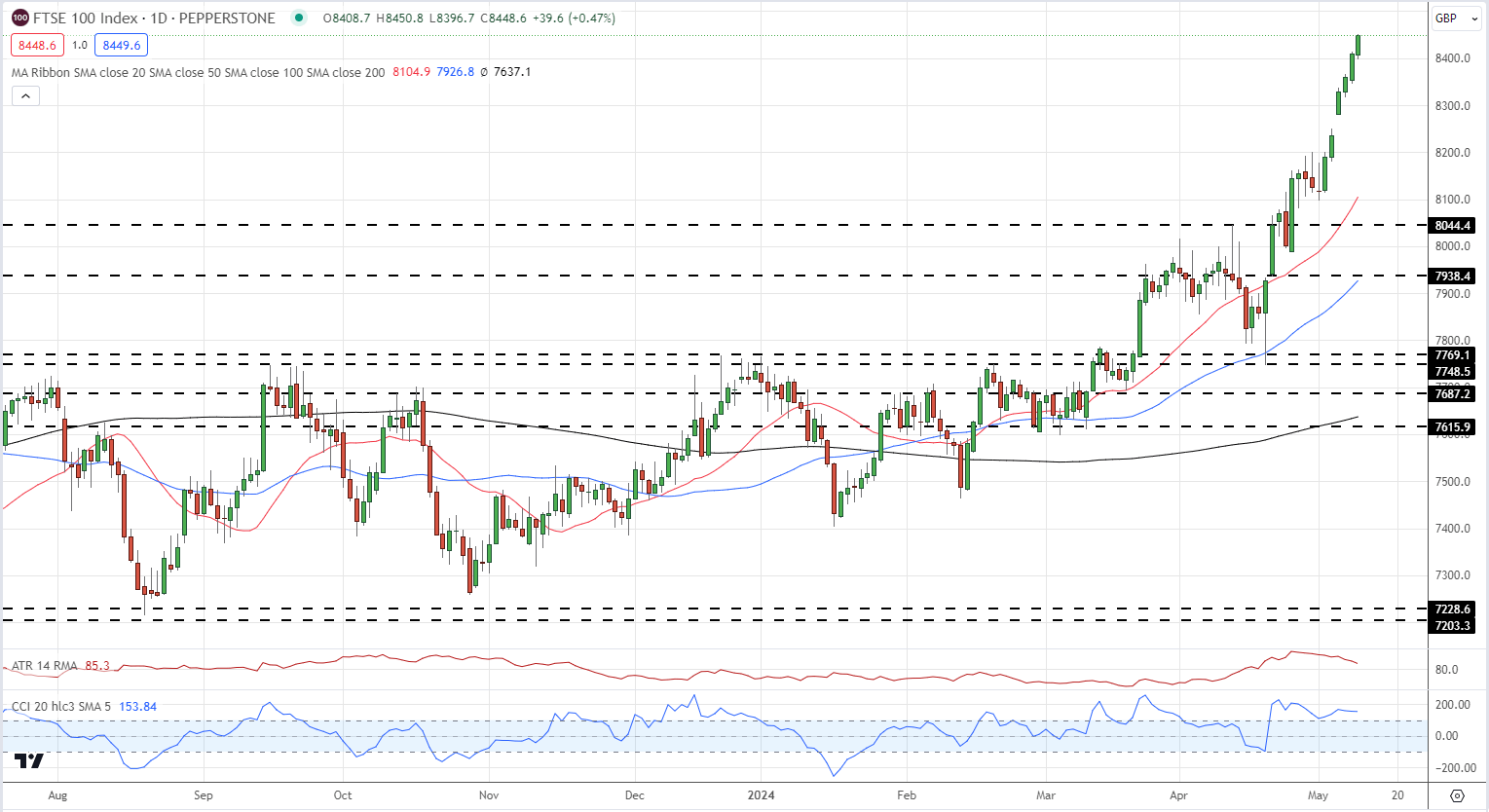

The FTSE 100 continues to post fresh all-time highs, with today’s GDP data sending the UK big board through the 8,400 barrier. The ongoing re-rating of the FTSE 100, and increased M&A activity has seen the index surge by around 1,000 points off this year’s low. Six green candles in a row underscore this week’s rally. Going into the weekend, the index may slow, but with UK economic confidence growing further, the outlook remains positive.

GBP/USD and FTSE100 Analysis and Charts

GBP/USD Daily Price Chart

Change in

Longs

Shorts

OI

Daily

8%

-14%

-5%

Weekly

11%

-13%

-4%

FTSE Daily Price Chart