Markets Week Ahead: Markets Risk-On, BoE Decision, Gold, Nasdaq, Bitcoin

Navigating Volatile Markets: Strategies and Tools for Traders

Download our Q2 US Dollar Technical and Fundamental Forecasts for free:

A busy week for a range of markets with the US dollar buffeted by Wednesday’s

FOMC

meeting and Friday’s weak NFP release, while in the US equity space, heavyweight earnings releases from Amazon, Block, Apple, and Coinbase kept traders busy. The world’s 2nd largest company gave the market a sizeable boost, announcing earnings beat across the board, an improved dividend, and the largest ever corporate buyback of $110 billion. Apple shares jumped around 9% Thursday before giving back some gains on Friday.

The tech-heavy

Nasdaq

ended the week in positive territory and at its highest level in over two weeks. A bearish flag formation can be seen on the charts but a break above trend resistance cannot be ruled out.

The economic data and events calendar is relatively quiet next week. However, the latest Bank of England decision (see the

British Pound

report below) and a handful of Fed speakers, will keep traders busy.

For all market-moving economic data and events, see the

FB Finance Institute

The Japanese Yen moved sharply higher against the US dollar over the week, driven by strong talk of official intervention. After hitting a spike high just above 160.00,

USD

/JPY tested prior support at 151.92 on Friday. The Japanese Yen gained across the board this week and is likely to continue this trend in the coming weeks.

USD/JPY Daily Price Chart

Gold

ended the week lower but the precious metal could not break a prior level of support around $2,280/oz. Lower US Treasury yields should be boosting gold but this is not happening now. The CCI indicator suggests that gold is oversold.

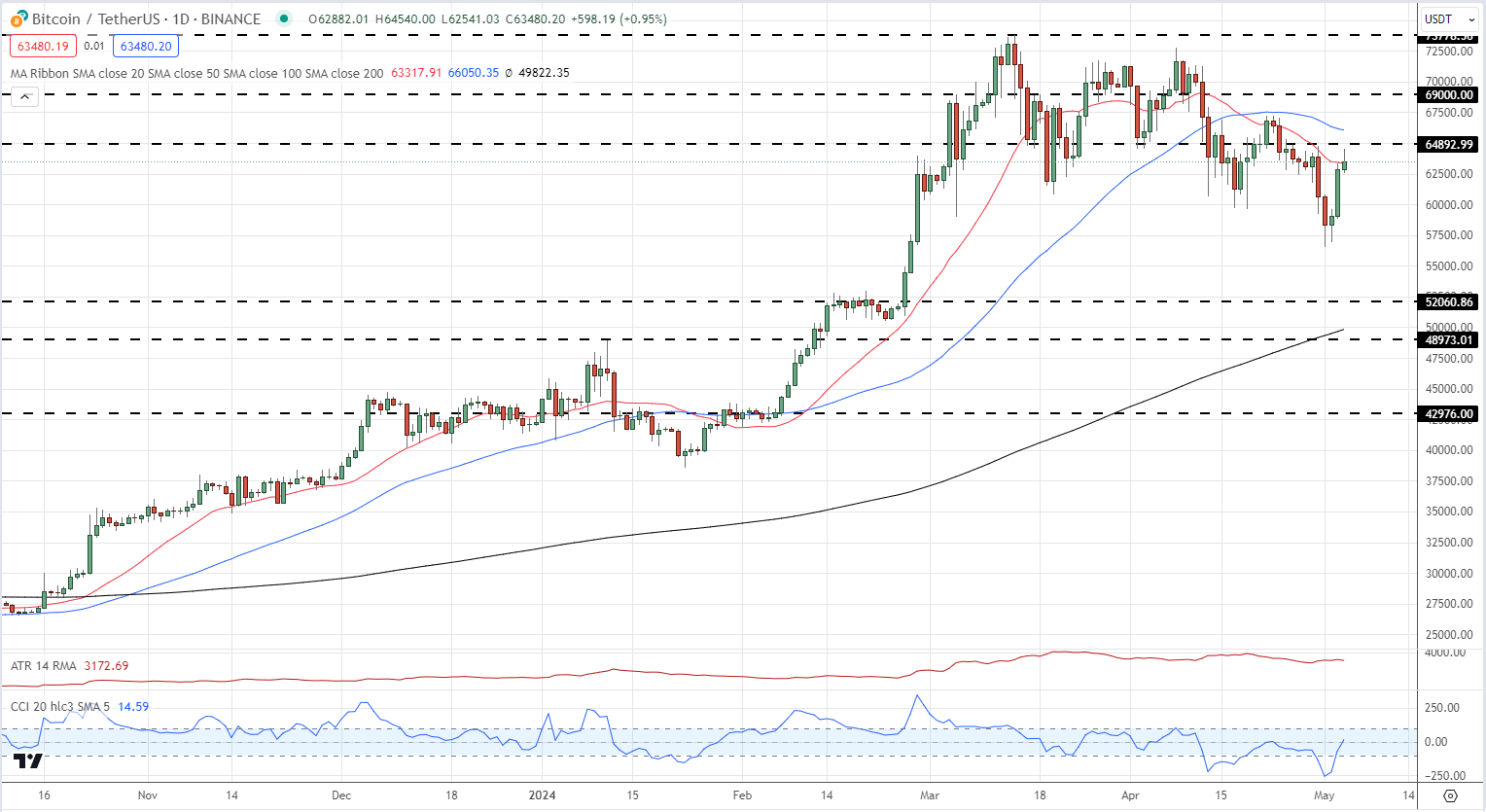

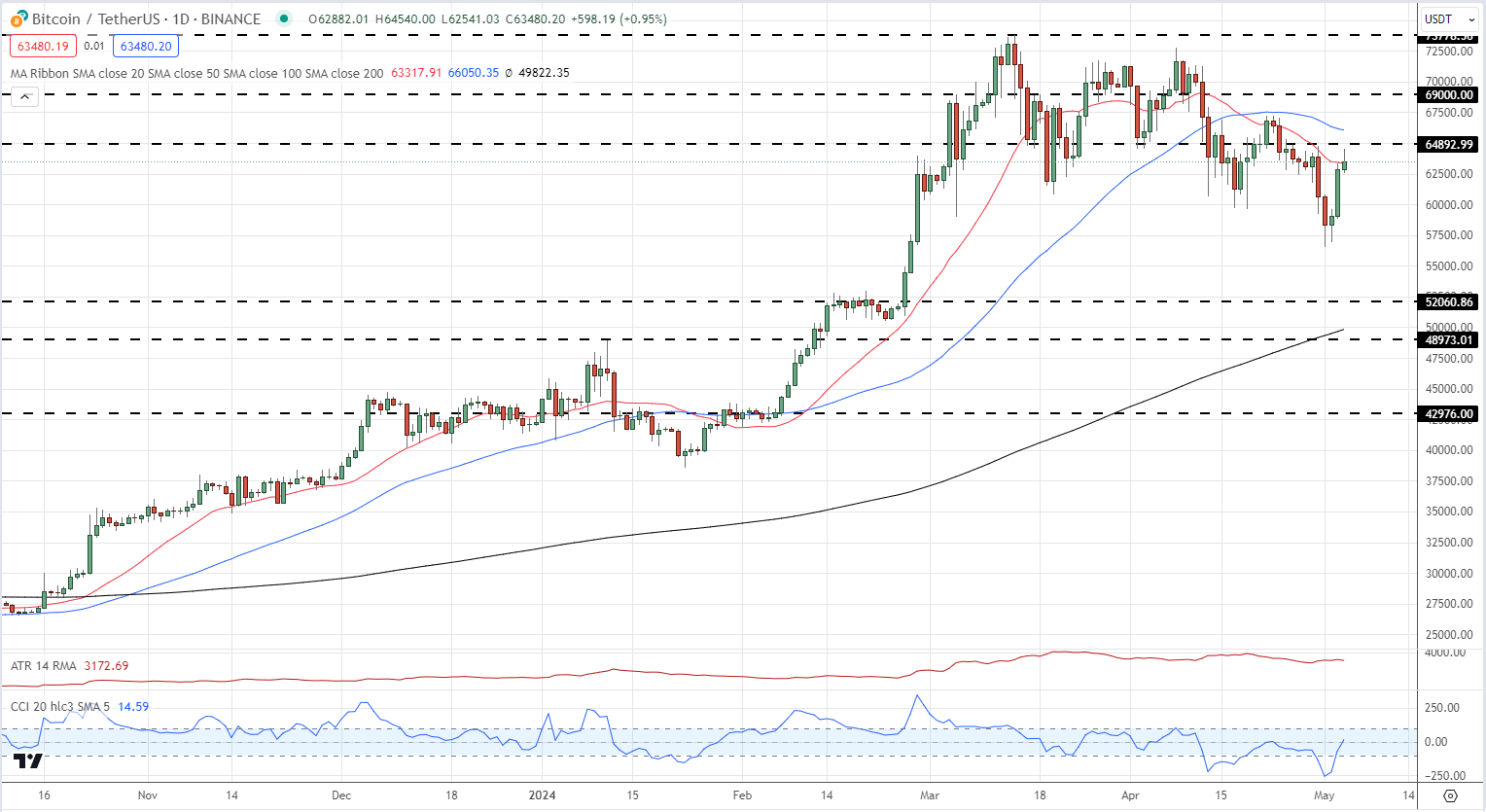

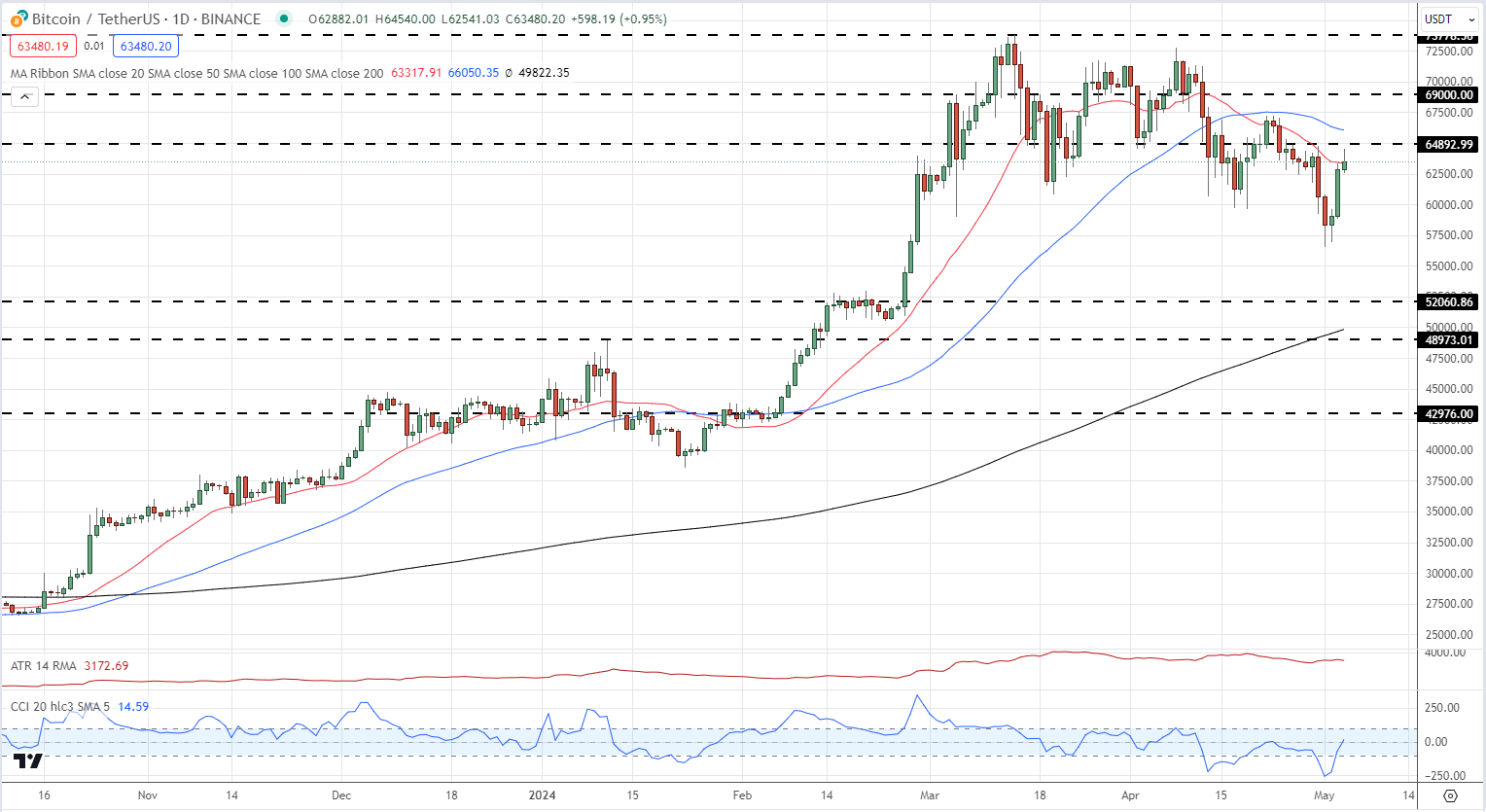

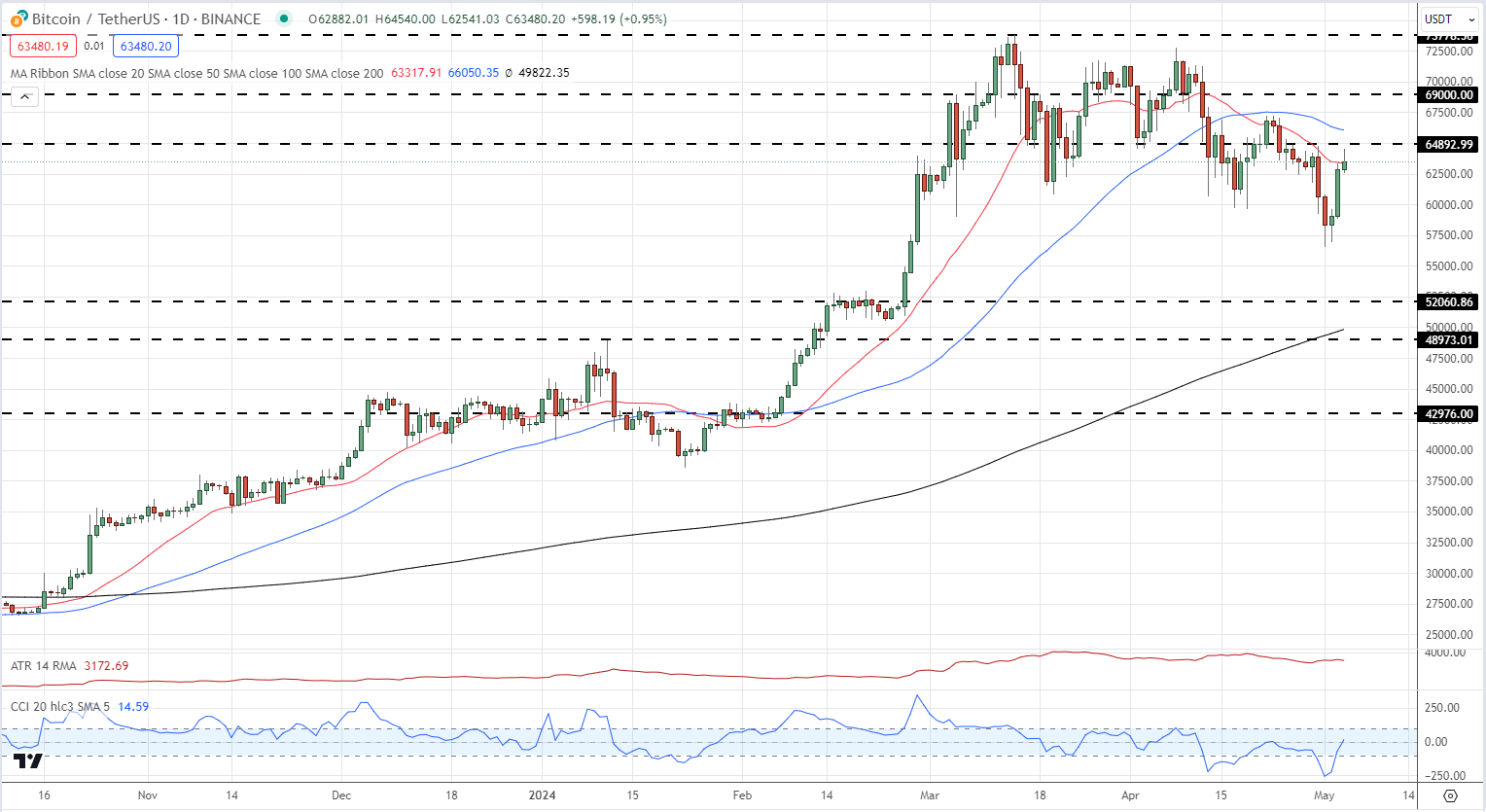

Bitcoin made a sharp turn higher on Friday on the back of little news. The CCI indicator shows that BTC/USD was heavily oversold on Wednesday and this coincided with Bitcoin’s move higher. A break and open above the $65k level leaves $69k as the next target.

Learn How to Trade Gold with our expert guide

All Charts using TradingView

Technical and Fundamental Forecasts – w/c May 6th

British Pound Weekly Forecast: BoE Policy Call Tops the Bill

The British Pound heads into a new trading week close to one-month highs against the United States Dollar, a tale that’s much more about the former than the latter.

Euro Weekly Forecast: EUR/USD Gains May be Limited, EUR/GBP Eyes BoE Decision

The US dollar turned sharply lower after the recent, weaker-than-expected US Jobs Report, boosting

EUR/USD

back above 1.0800. A lack of meaningful EU data next week will leave the

Euro

exposed.

Gold Price Forecast: Bearish Correction May Extend Further Before Turnaround

This article explores the near-term fundamental and technical outlook for gold, analysing possible scenarios taking into account current market dynamics and price action.

US Dollar Forecast: Bearish Market Signals Emerge – Setups on EUR/USD, GBP/USD

This article takes a thorough look at the fundamental and technical outlook for the U.S. dollar, analyzing potential scenarios that could manifest in the short run. Especial attention is given to two key pairs: EUR/USD and

GBP/USD

.

Markets Week Ahead: Markets Risk-On, BoE Decision, Gold, Nasdaq, Bitcoin

Nasdaq Daily Price Chart

Gold Daily Price Chart

Chart of the Week – Bitcoin