British Pound Down But Paring Losses Vs Dollar As Market Looks to Fed

Download are Q2

British Pound

Technical and Fundamental Outlooks for free below:

The Pound seems to have stalled close to one-month highs against the United States Dollar on Tuesday, with the cable market like all others now fixed on the Federal Reserve’s May

monetary policy

call. That’s coming up on Wednesday and the wait for it will probably sap European market appetite.

The US central bank is not tipped to alter interest rates, but its commentary will be combed through to see whether the markets’ view of when it will cut them remains tenable. The US economy has proven much more resilient than seemed possible at the start of this year. Consequently, the first interest rate reduction is now not expected until the end of the third quarter, and even that expectation is tentative.

The Bank of England meanwhile is thought likely to start trimming its own key borrowing costs in August, with the European Central Bank expected to move two months before that.

Of course, all these views remain heavily data-dependent, with

inflation

heading lower but still above target across most developed economies. For its part, the BoE has said that inflation appears to be heading in the right direction but that significant uncertainties remain.

GBP/

USD

has risen steadily this month, buoyed up by a modest increase in risk appetite and London stock markets’ full participation in strong gains for equity. However the pair remains within a broader downtrend from the peaks of March, which makes sense given those interest rate forecasts. For as long as they make sense, it’s hard to see durable gains for Sterling.

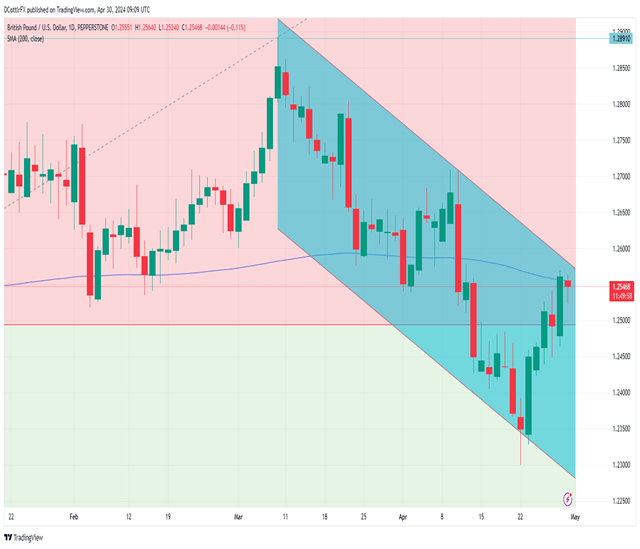

GBP/USD Daily Chart Compiled Using Trading View

Bulls appear to be running out of steam close to the 200-day moving average, which now comes in at 1.25563, but at this stage, it’s hard to say whether this is a genuine topping out or merely (and more probably) a little caution ahead of the Fed.

Durable gains above this would put the current downtrend channel top very much in play. A break above that would be significant as it has dominated trade since March. It now offers resistance at 1.25791.

Reversals will concentrate initially on retracement support at 1.24947, and bulls will strive to keep the market above 1.2300 psychological support, as it defends this month’s six month low, posted on April 23.

Given current fundamentals the most likely near-term path for GBP/USD is to remain within its downtrend band with occasional tests of its topside. Gains above that level should probably be treated with skepticism unless they come with solid fundamental news, underlining the need to combine both technical and fundamental elements.

--By David Cottle for DailyFX

British Pound: GBP/USD Analysis and Charts

GBP/USD Technical Analysis