Japanese Yen Latest: USD/JPY and GBP/JPY Technical Analysis and Outlooks

Japanese Yen

USD/JPY

and

GBP/JPY

Prices

, Charts, and Analysis

Our Brand New Q2 Japanese Yen Fundamental and Technical Analysis Reports are Free to Download

Most Read:

USD/JPY Latest: Trilateral Meeting Hints at Co-ordinated Intervention Effort

The Bank of Japan will announce its latest

monetary policy

decision on Friday, and while the central bank is fully expected to leave all policy settings untouched, as with all central bank meetings, post-decision commentary is key. Current financial market expectations are showing just a 10% probability of a 10 basis point rate hike and unless the BoJ gives the market something to work with, and not just talk about following the exchange rate closely, the Japanese Yen is set to remain weak.

This week also sees three important US data releases, durable goods, the first look at Q1

GDP

, and the latest Core PCE reading. US growth is seen slowing, but remains robust, while a move in Core PCE will give the Federal Reserve some wiggle room for one or possibly two rate cuts later this year.

For all market-moving global economic data releases and events, see the

FB Finance Institute

The

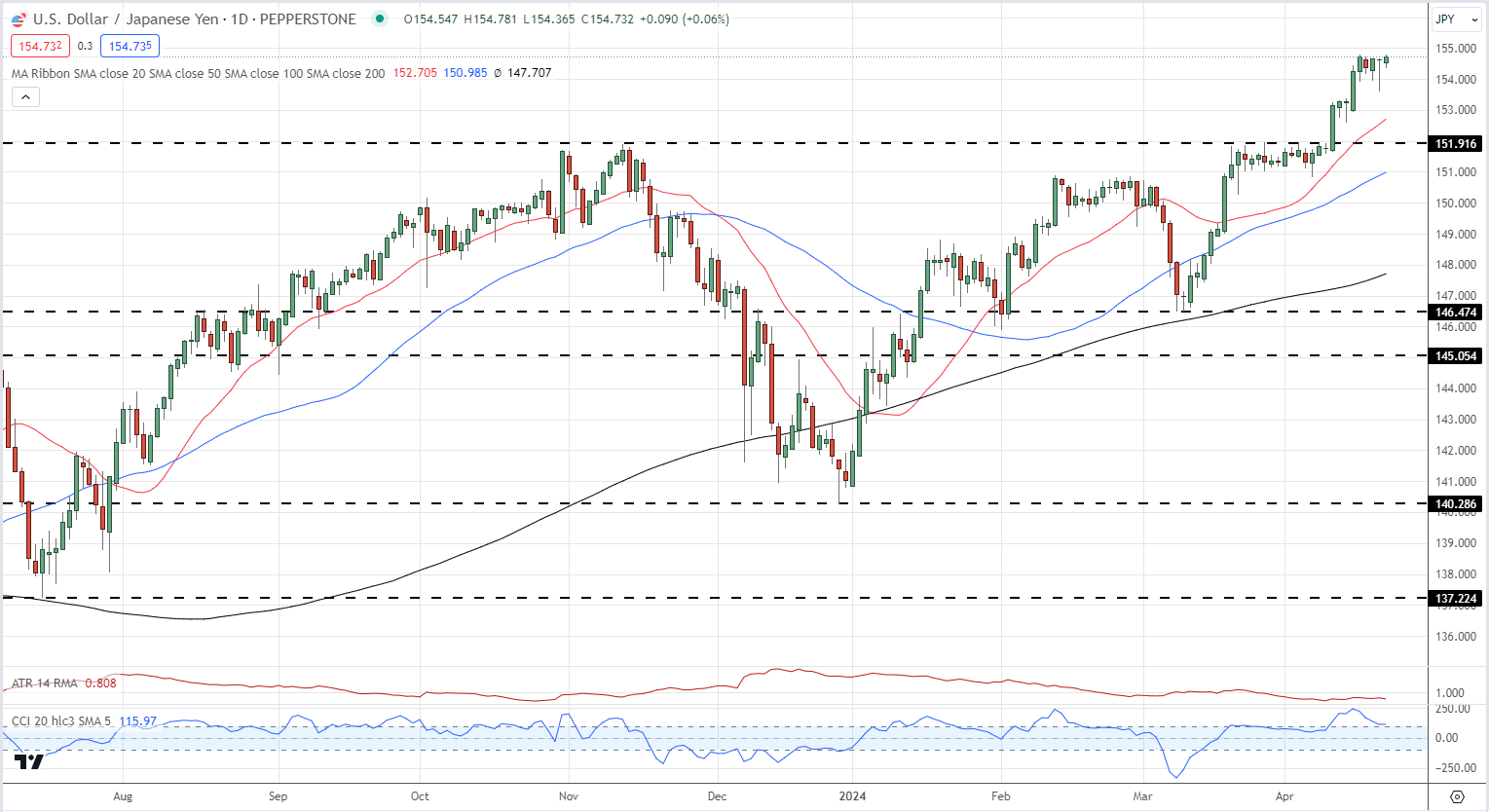

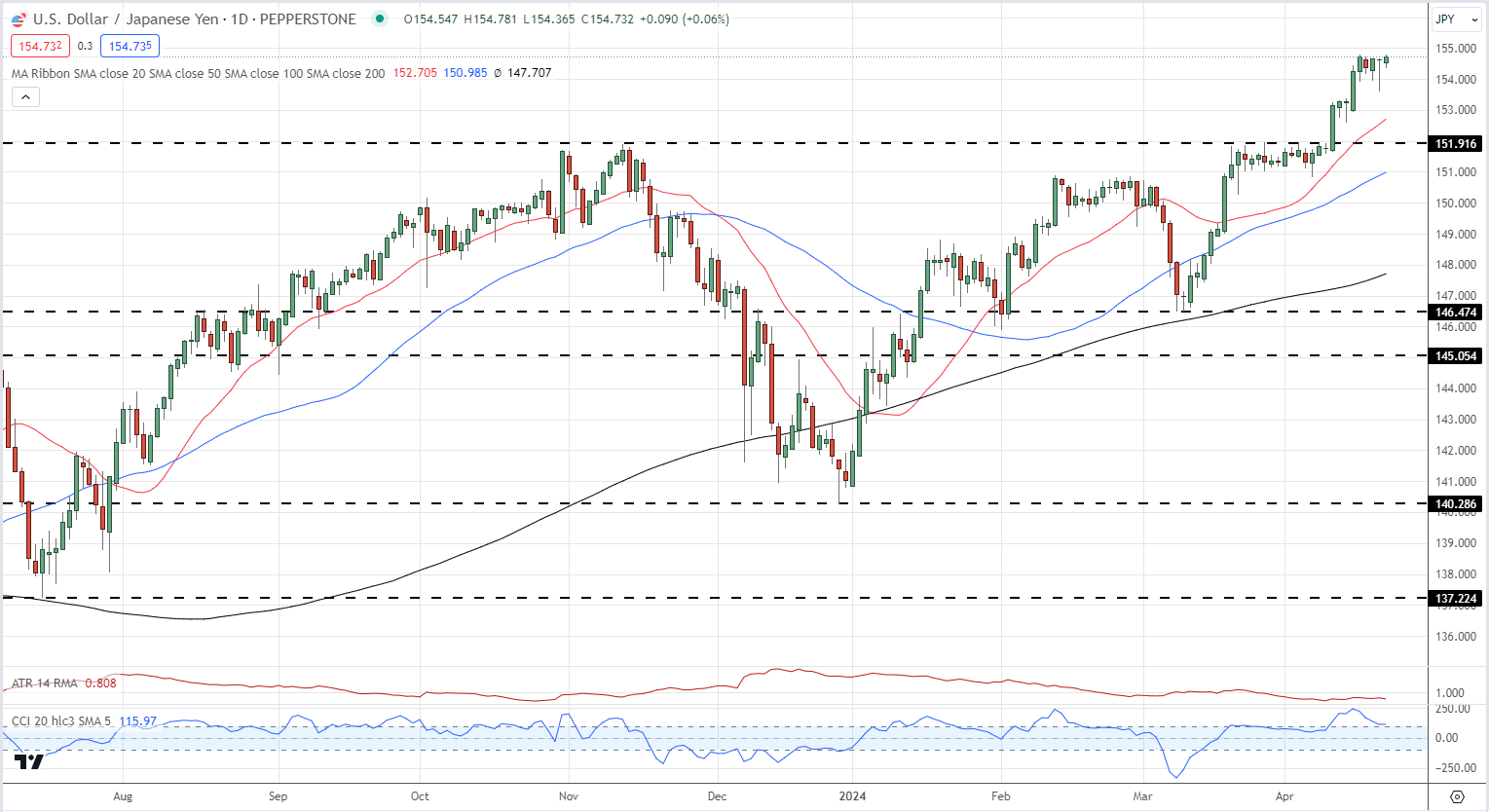

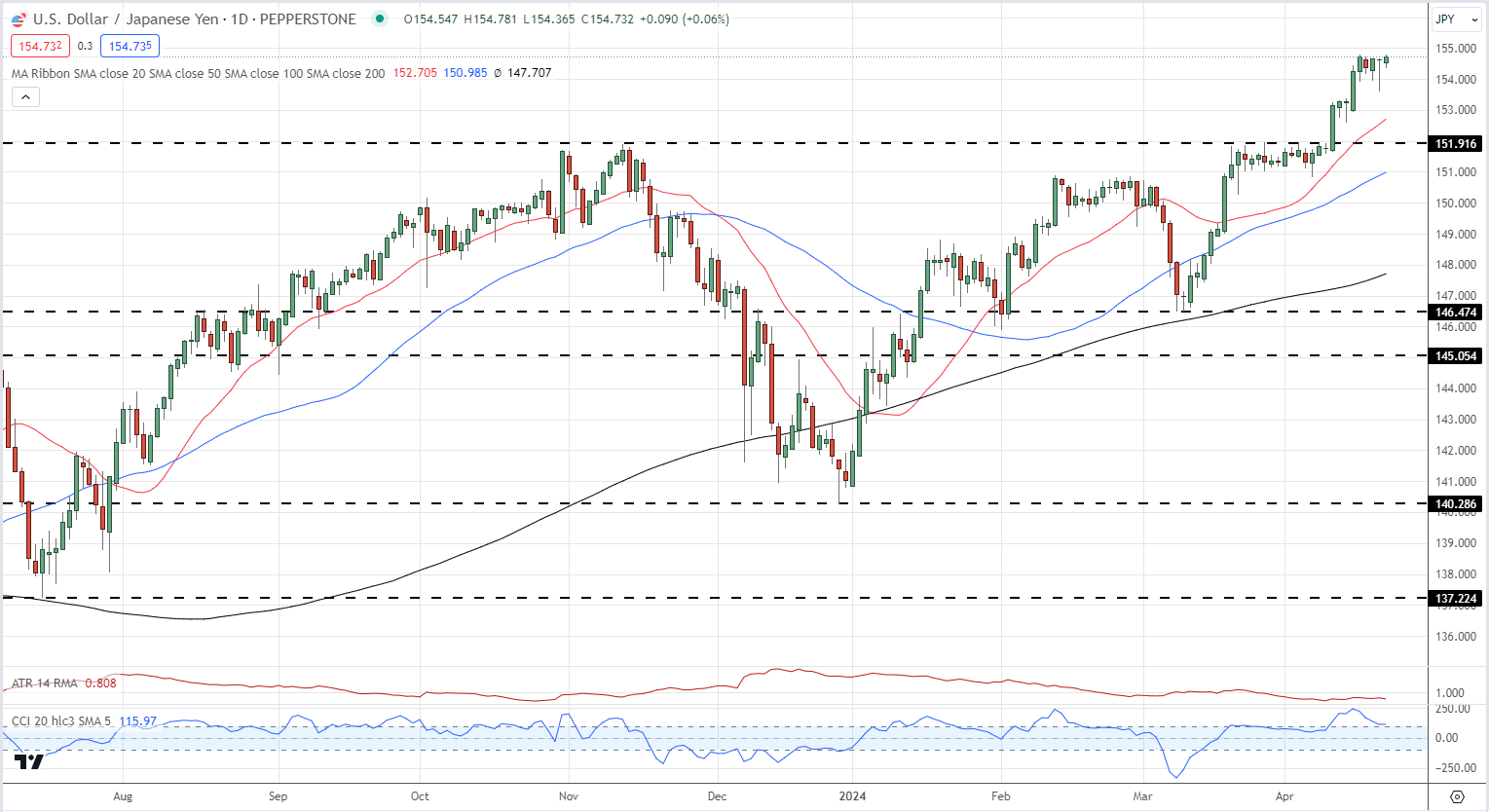

US dollar

is pushing higher today and is looking set to post a fresh multi-month high. US Treasury yields remain elevated and will stay that way this week as $183 billion of combined 2s, 5s, and 7s hit the street. In addition, the

Euro

continues to slip lower, while Sterling is under pressure on renewed rate cut hopes. The Euro (57.6%) is the largest component of the dollar index, while the British Pound (11.9%) is the third-largest. If the dollar index breaks last week’s 106.58 high, the October 2nd print at 107.33 becomes the next level of resistance.

According to market thoughts, including ours, the 155.00 is the line in the sand for USD/JPY before official intervention is seen. This level now looks increasingly vulnerable due to recent US dollar strength. The technical outlook also looks bullish and a break above could see the pair move to 156.00 or 157.00 with speed. A difficult pair to trade currently with the BoJ/MoF looking on with great interest.

Learn How to Trade USD/JPY with our Free Guide

Download the Latest IG Sentiment Report and Discover How Daily and Weekly Shifts in Market Sentiment can Impact the Price Outlook

:

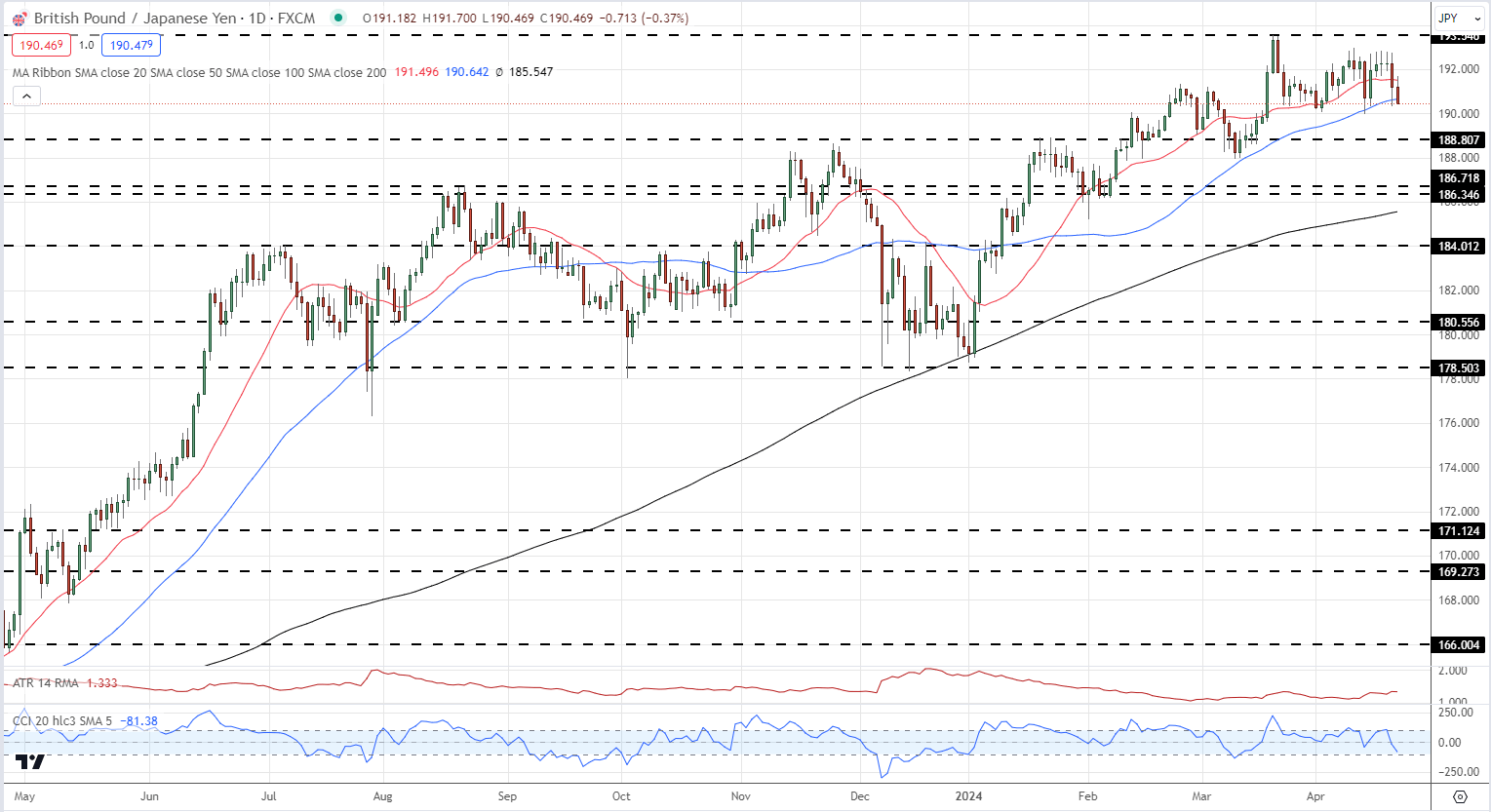

The recent GBP/JPY sell-off is nearly all due to Sterling weakness as

BoE rate

expectations are pulled in. After battling with the 192-193 area for the best part of this month, recent Sterling weakness has seen the pair drop to around 190.50. A break below 190.00 will bring the 188.80 area into play before 186s act as support. This year’s series of higher lows remains intact, and the series of higher highs looks to be broken.

GBP/USD, EUR/GBP Outlooks – Sterling Weakens After Bank of England Commentary

US Dollar Index Daily Chart

USD/JPY Daily Price Chart

Change in

Longs

Shorts

OI

Daily

-14%

1%

-3%

Weekly

-3%

-4%

-4%

GBP/JPY Daily Price Chart