Gold Price Update: Israeli Attack Lifts Safe Haven Appeal, Weighs on Risk Assets

Gold

prices

spiked higher in the early hours of Friday morning after reports emerged of the Israeli strike on Iran. The back and forth between the two nations risks sparking a broader conflict between the two and prompted a short-lived flight to safety.

Uncertainty surrounding the conflict in the Middle East has helped push gold prices higher and higher, nearly testing the all-time high around $2431.

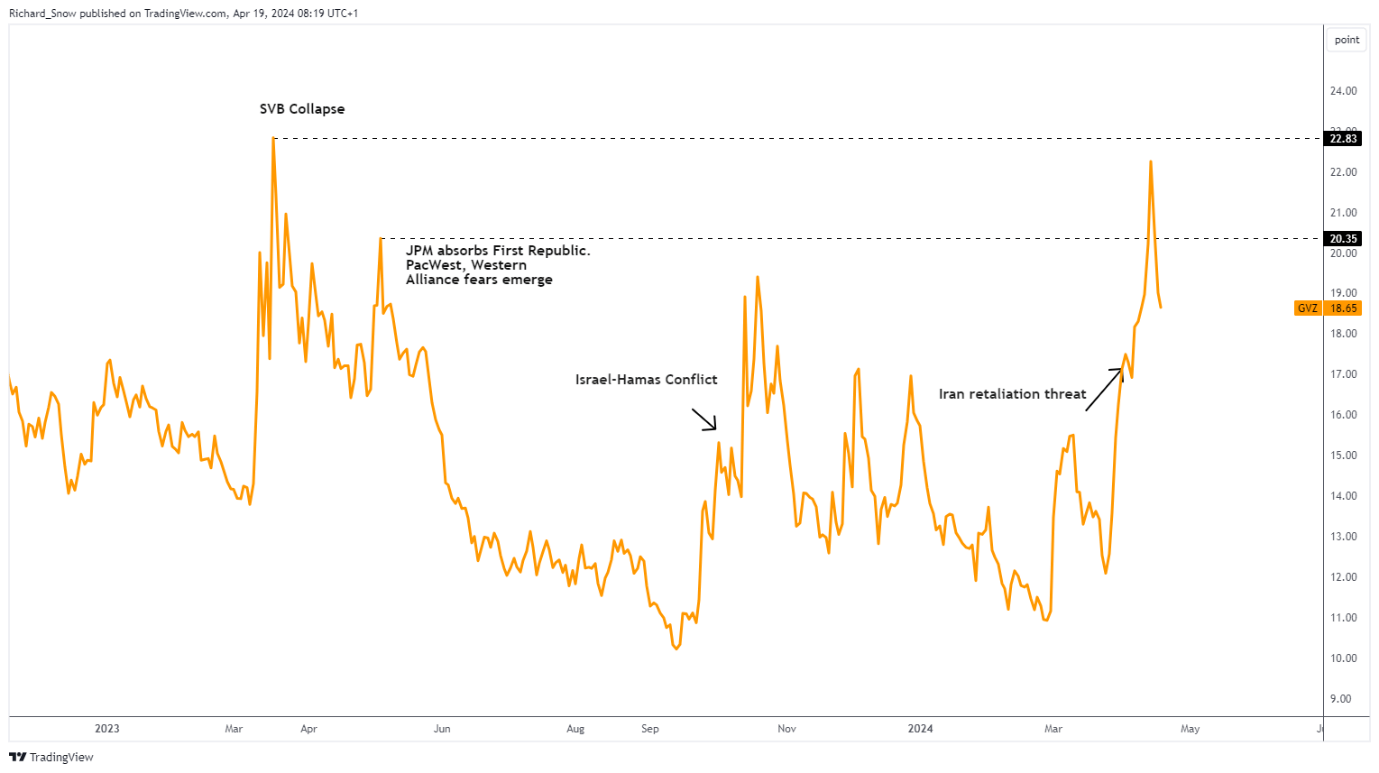

On the daily chart, gold continues to trade within overbought territory but the degree of overheating has been cooling down – suggesting a slow down in bullish momentum within the broader uptrend.

The 1.618

Fibonacci extension

of the 2020-2022 move reemerges as support at $2360, with a pocket of higher lows providing an area of further interest around the $2320 level. A strong

US dollar

and rising Treasury yields have done little to deter the rampant rise in the precious metal as central bank buying continues to add to the tailwind.

Gold (XAU/

USD

) Daily Chart

Source: TradingView, prepared by

Richard Snow

Gold market trading involves a thorough understanding of the fundamental factors that determine gold prices like demand and supply, as well as the effect of geopolitical tensions and war. Find out how to trade the safe haven metal by reading our comprehensive guide:

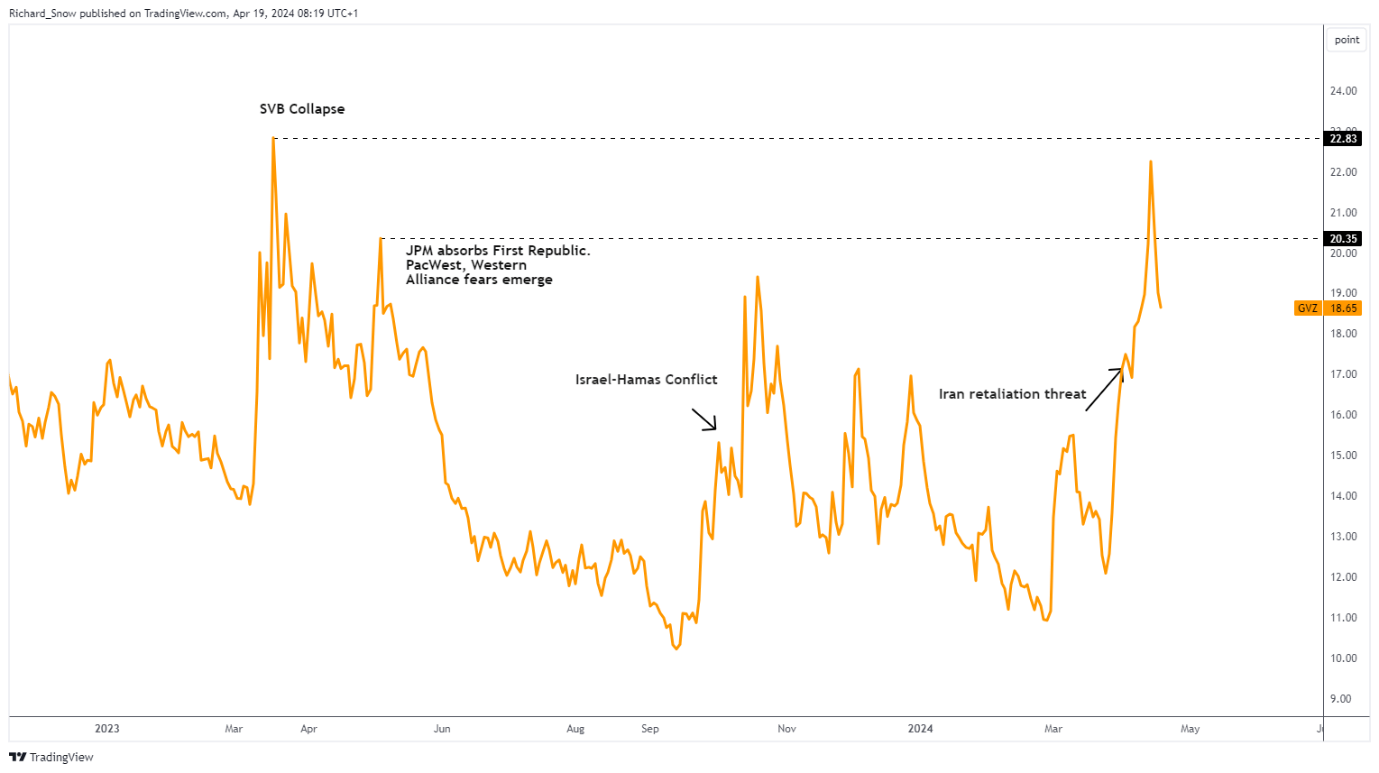

While US stock markets were closed, the FX market was on hand to reveal the immediate response as soon as news broke of an Israeli attack on Iran. Traditional safe-haven currencies like the

Swiss franc

,

Japanese yen

and US dollar registered gains, while the more risk-aligned (high beta)

Australian dollar

witnessed the sharpest decline.

AUD has plummeted in recent days due to its historical correlation with the

S&P 500

, which is on track for a third straight weekly decline. In addition, Chinese economic prospects remain underwhelming, adding further to the headwinds for AUD.

Immediate Flight to Safety Exhibited in the FX market Overnight

Source: Financial Juice, prepared by

Richard Snow

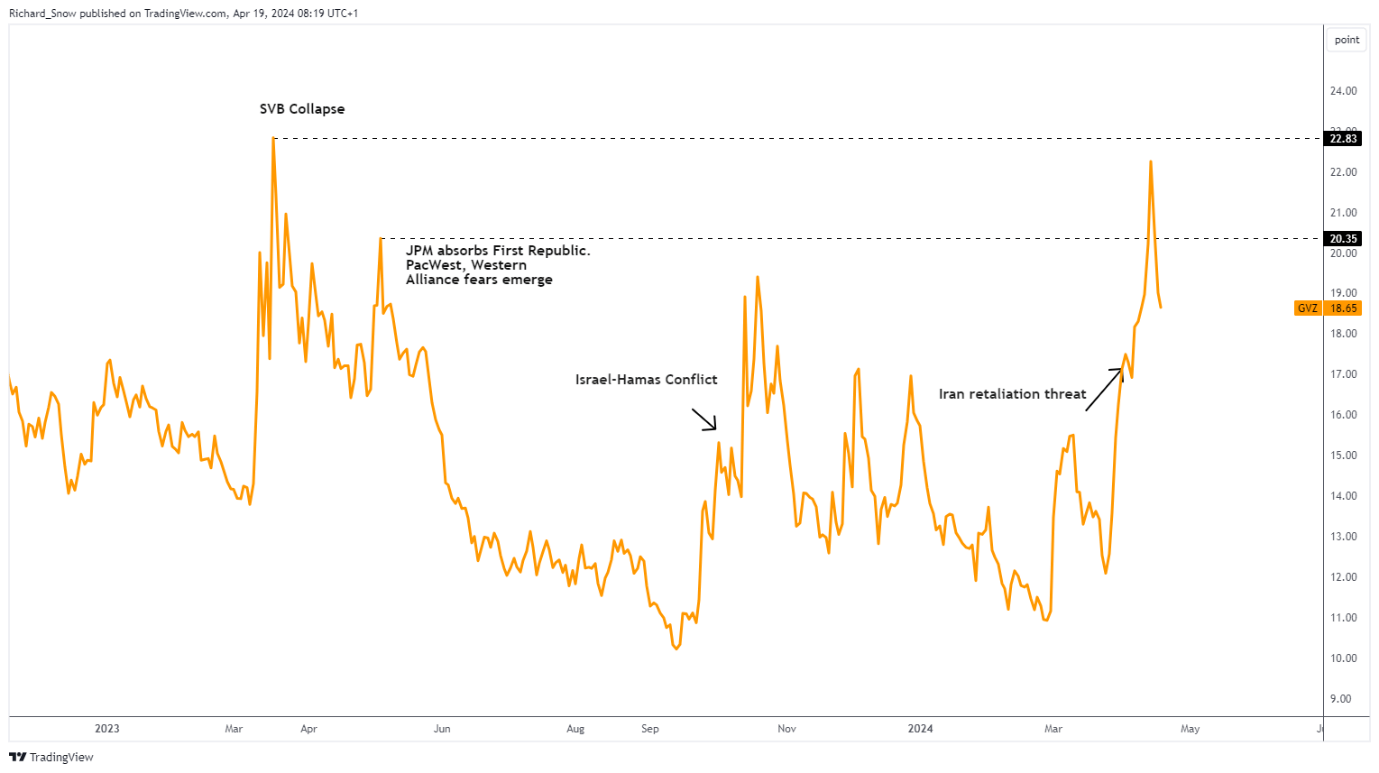

The 20-day implied gold volatility (GVZ) index provides a forward-looking measure of gold market volatility, hence its usefulness to investors and traders. Recent volatility has dipped and the focus will be on whether the two nations consider the recent flareup finished or is Iran intends to respond once again.

30-Day Implied Gold Volatility (GVZ)

Source: TradingView, prepared by

Richard Snow

Gold (XAU/USD) Analysis

Gold Spiked Higher, Falling Narrowly Short of the All-Time High

Gold Volatility Index in Focus