Aussie Dollar Plummets Amid Conflict Escalations and Chinese GDP Data

The Aussie dollar is commonly known to trade in a similar fashion to the

S&P 500

index, rising during the good times and falling during economic downturns. The ‘high beta’ currency has actually exhibited a disconnect from the longer-term, positive correlation with the S&P 500 as Chinese economic prospects have worsened. Australia is highly dependent of China’s appetite for its largest import, iron ore, but a flailing property sector and uncertain external environment has forced China to be more selective with its imports – a drag on

AUD

.

Last week, the Aussie dollar posted a massive decline, erasing the early April gains. This week traders will need to monitor the uncertain geopolitical environment in the Middle East as it impacts risk appetite, as well as Australian jobs data and Chinese GDP for the first quarter.

AUD/

USD

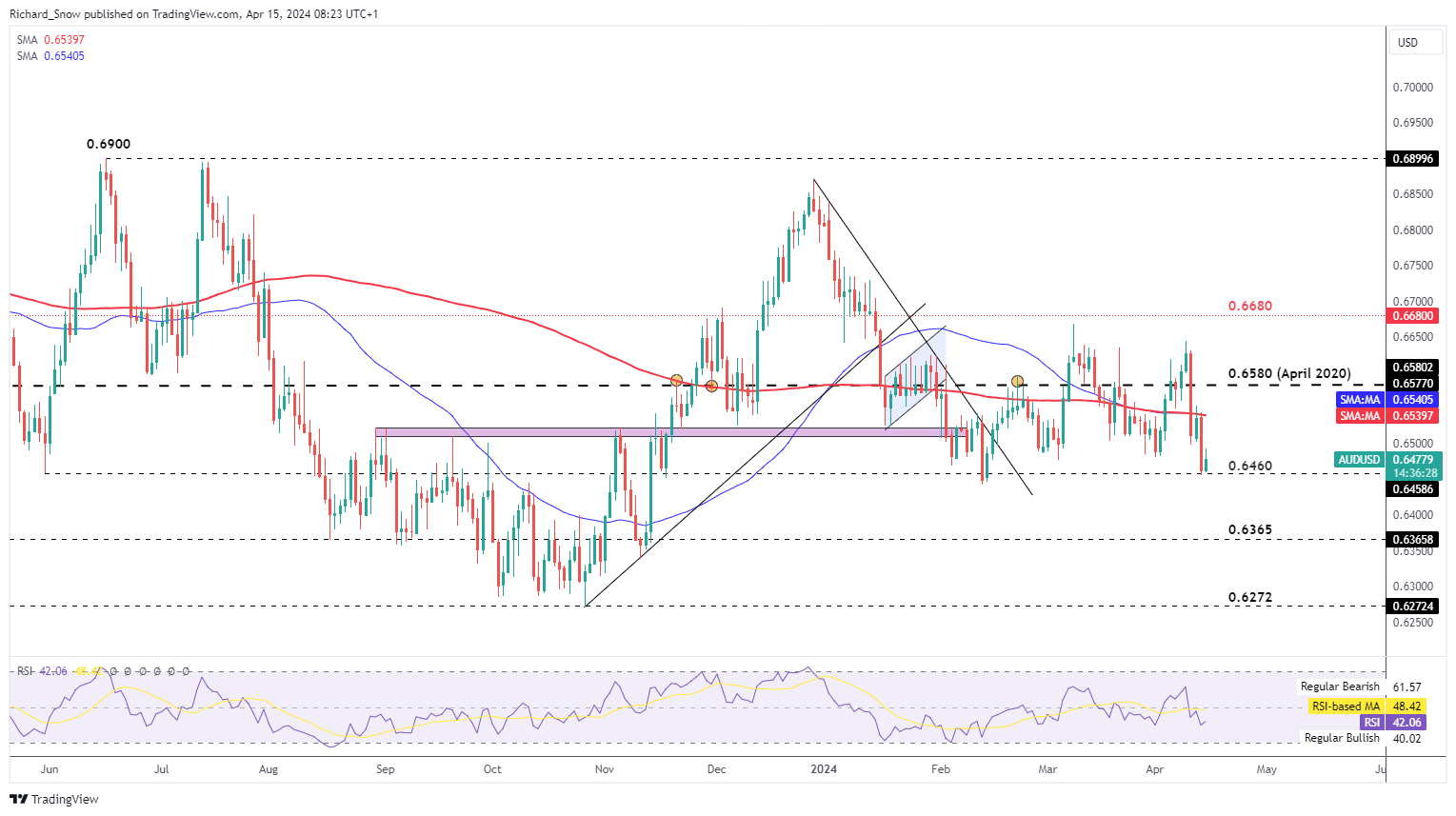

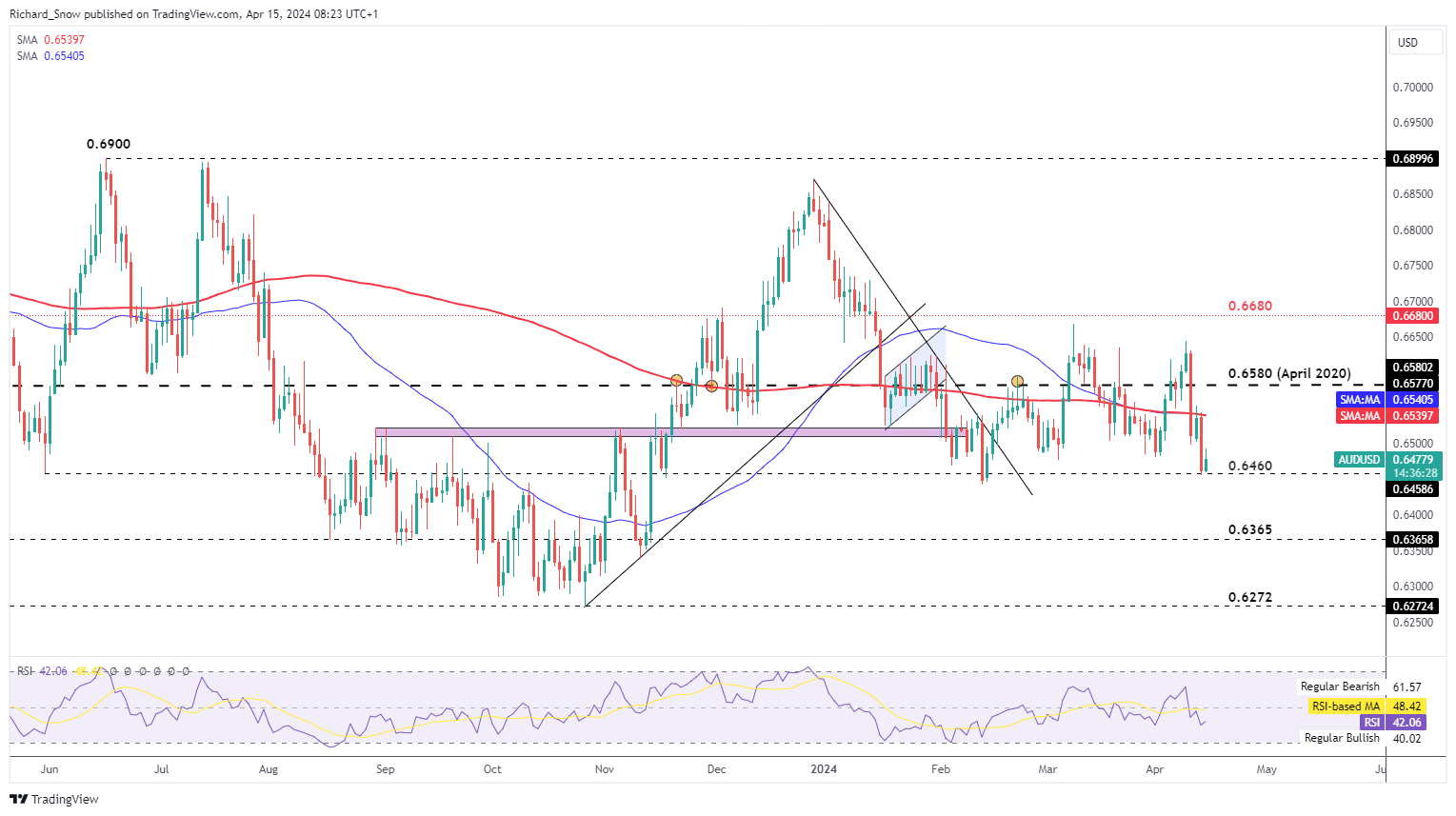

Daily Chart and SPX Overlay

Source: TradingView, prepared by

Richard Snow

AUD/USD posted a positive start to the week after appearing to find momentary support at 0.6460 – the 31st of May 2023 swing low. Last week’s sharp decline provides the backdrop for a potential ‘

death cross

’ at the start of the week. If Chinese GDP proves lackluster, AUD may come under pressure until the Aussie jobs data on Thursday.

Keep in mind a potential retaliation from Israel for the barrage of Iranian drones fired at Israel over the weekend, as this could send the pair lower, towards 0.6365 as the

RSI

is not yet near oversold territory.

However, if Israel heeds the strong calls from US President Joe Biden and the UN, a moment of relative calm may prevail but that alone is unlikely all it will take to see AUD/USD fully reclaim recent losses.

AUD/USD Daily Chart

Source: TradingView, prepared by

Richard Snow

FX pairs have their own idiosyncrasies that all traders should be aware of. Discover what moves AUD/USD via our comprehensive guide below:

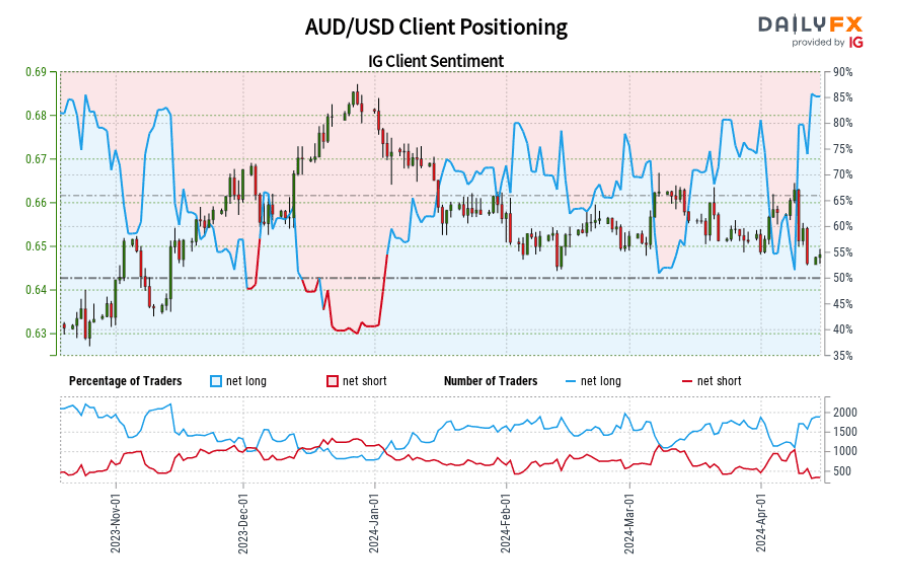

AUD/USD: Retail trader data shows 83.80% of traders are net-long

with the ratio of traders long to short at 5.17 to 1.

We typically take a contrarian view to crowd sentiment

, and the fact traders are net-long suggests AUD/USD

prices

may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a

further mixed AUD/USD trading outlook

.

See how to read and apply IG client sentiment data to your trading process via the dedicated guide below:

AUD/USD Analysis

Aussie Dollar Posts Massive Weekly Decline Ahead of Chinese GDP and AUS Jobs Data

AUD/USD Finds Momentary Support in a Crucial Week for Risk Assets

Change in

Longs

Shorts

OI

Daily

6%

-15%

-3%

Weekly

16%

-28%

-5%