Gold Price Outlook: Drivers Behind Market Boom, Reversal or New Record Ahead?

Most Read:

US Dollar on Defense Before Key US CPI Data – Setups on EUR/USD & USD/JPY

Gold

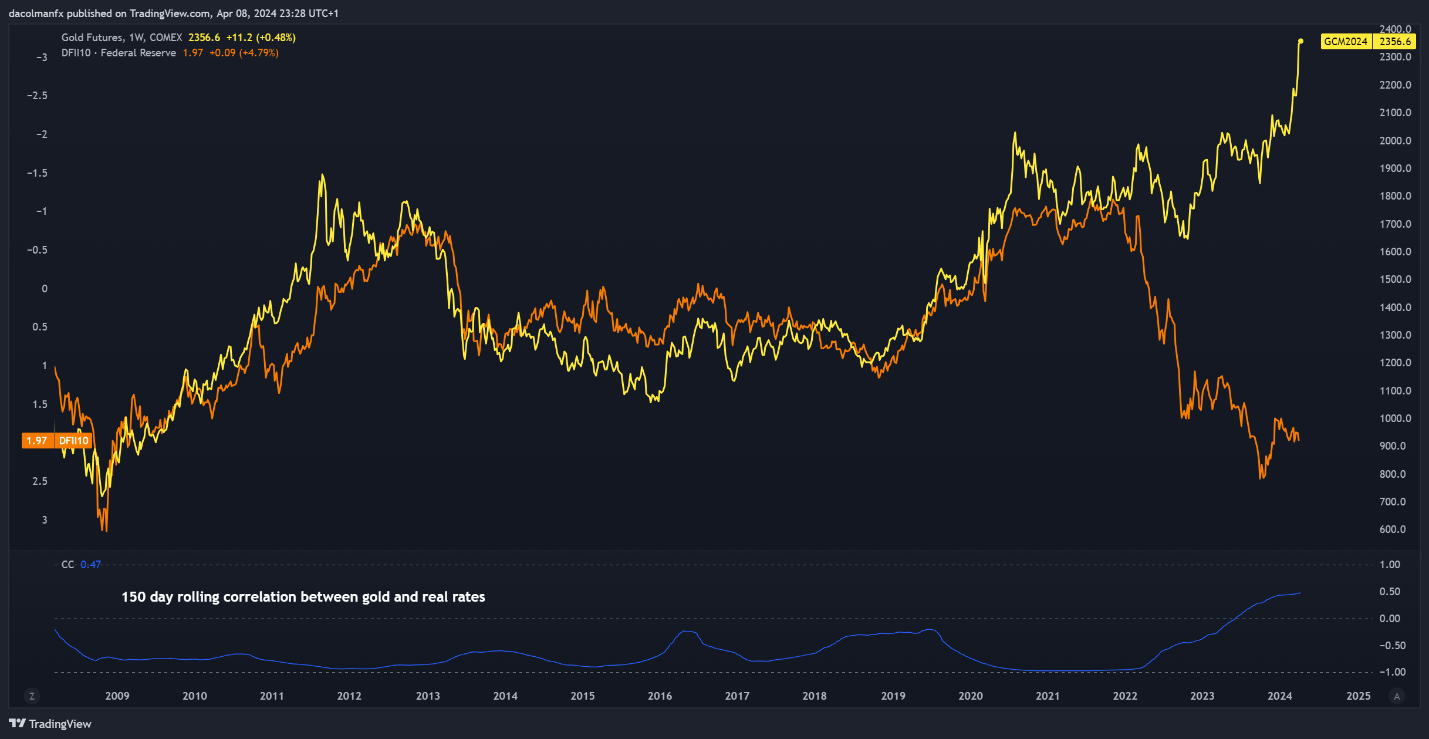

has soared and hit one record after another this year, with the bulk of the bullish move taking place over the course of the past two months. During this upswing, the typical negative relationship between XAU/

USD

and U.S. real rates (using the U.S. 10-year TIPS as a proxy) has broken down dramatically, unnerving investors.

As the chart below illustrates, bullion has climbed even as real yields (displayed on an inverted scale for better visualization) have risen relentlessly. This unexpected dynamic runs counter to the norm – higher bond yields typically dampen the appeal of non-interest-bearing assets like the yellow metal, as investors seek better returns in the fixed-income space.

Source: TradingView

For an extensive analysis of gold’s fundamental and technical outlook, download our complimentary Q2 forecast now!

I am inclined to believe in the first hypothesis. The annals of history are replete with instances where popular assets have fallen prey to speculative appetite, propelling prices to unsustainable heights divorced from underlying economic fundamentals. This unsustainable momentum creates a distorted environment where valuations lose touch with intrinsic value. Eventually, sentiment shifts, and a sharp correction follows, restoring a more realistic market equilibrium. I think this could happen to gold over the medium term.

Wondering how retail positioning can shape gold prices in the near term? Our sentiment guide provides the answers you are looking for—don't miss out, get the guide now!

WHAT COULD EXPLAIN CURRENT MARKET DYNAMICS?

PERSONAL VIEW

Change in

Longs

Shorts

OI

Daily

5%

-17%

-4%

Weekly

2%

-14%

-4%