US Dollar Index Prints a One-Month High, USD/JPY Rallies Post-BoJ Meeting

The US dollar index continues its recent move higher, aided by a weaker

Euro

and Japanese Yen. The Euro is still feeling the effects of last weekend’s European Parliamentary Elections and expectations of further rate cuts this year, while the Japanese Yen moved lower after the Bank of Japan said that it would pare back its bond-buying program but the market would have to wait until the July 31st meeting for any details. The Euro (58%) and the Japanese Yen (13.6%) are the two largest constituents of the six-currency index.

The Japanese Yen is weakening further against a range of currencies after the Bank of Japan policy meeting. Financial markets had expected the Japanese central bank to give more details about paring back their bond-buying program –

monetary policy

tightening – and the lack of any formal schedule left the Yen untethered.

With the next policy meeting not until the end of July, and with

USD/JPY

at levels that official intervention has been seen before, the Bank of Japan will have a tricky few weeks trying to keep the Yen from depreciating further.

IG retail client sentiment shows 22.82% of traders are net-long with the ratio of traders short to long at 3.38 to 1.The number of traders net-long is 6.99% lower than yesterday and 22.81% lower from last week, while the number of traders net-short is 8.89% higher than yesterday and 5.62% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests

USD

/JPY

prices

may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a

stronger USD/JPY-bullish contrarian trading bias.

US Dollar Index Prints a One-Month High, USD/JPY Weakens Post-BoJ Meeting

US Dollar Index Daily Chart

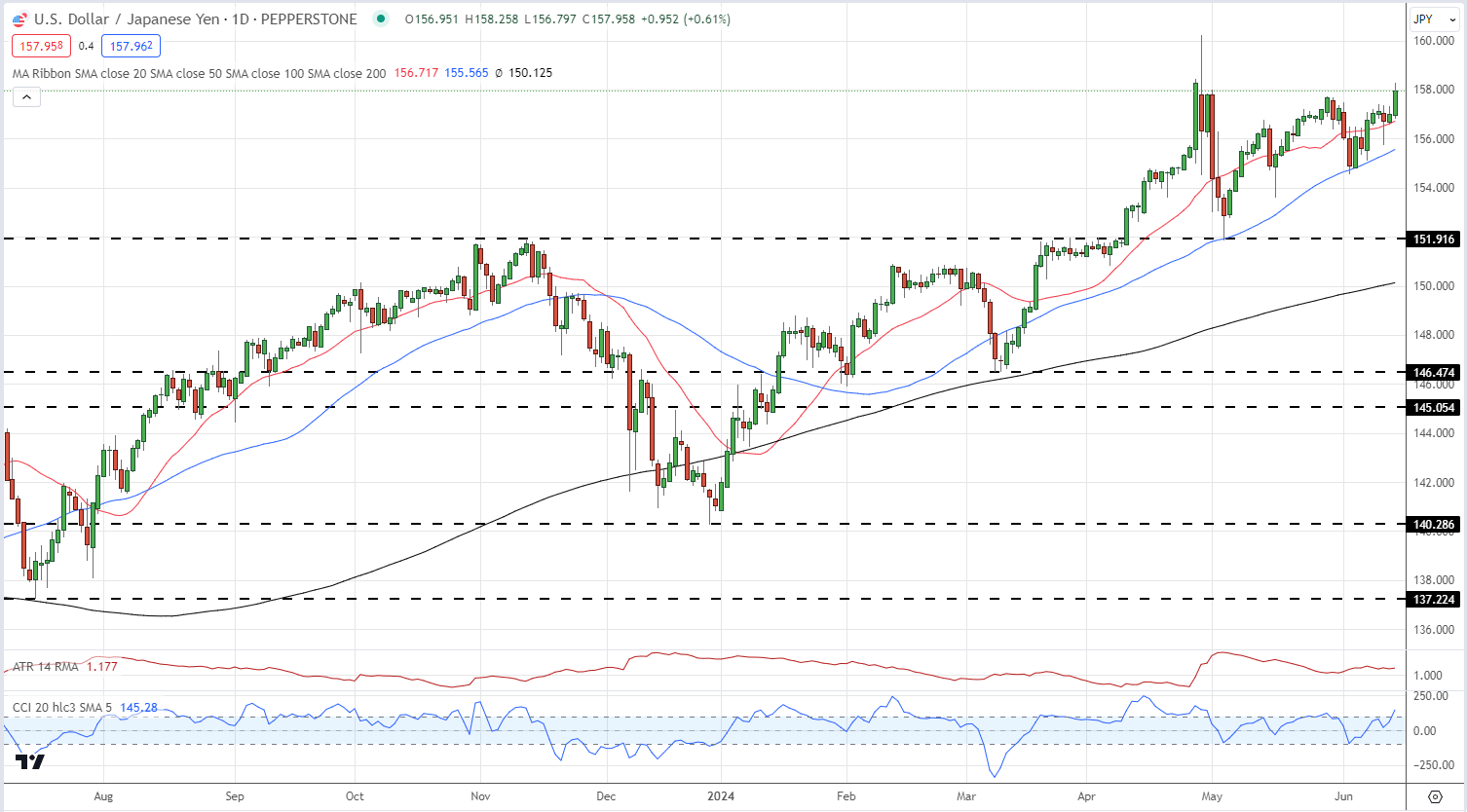

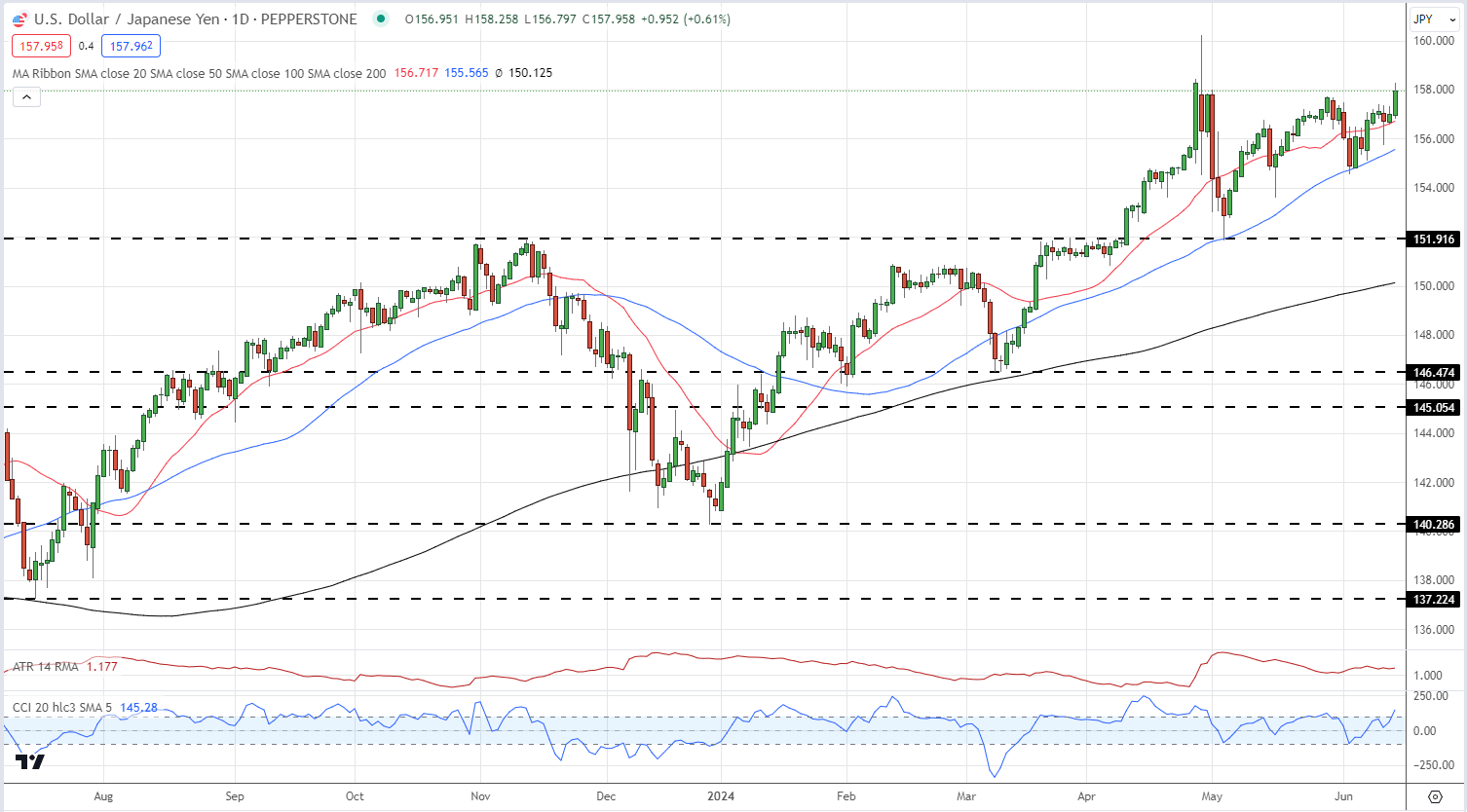

USD/JPY Daily Chart

Change in

Longs

Shorts

OI

Daily

6%

-1%

0%

Weekly

3%

1%

1%