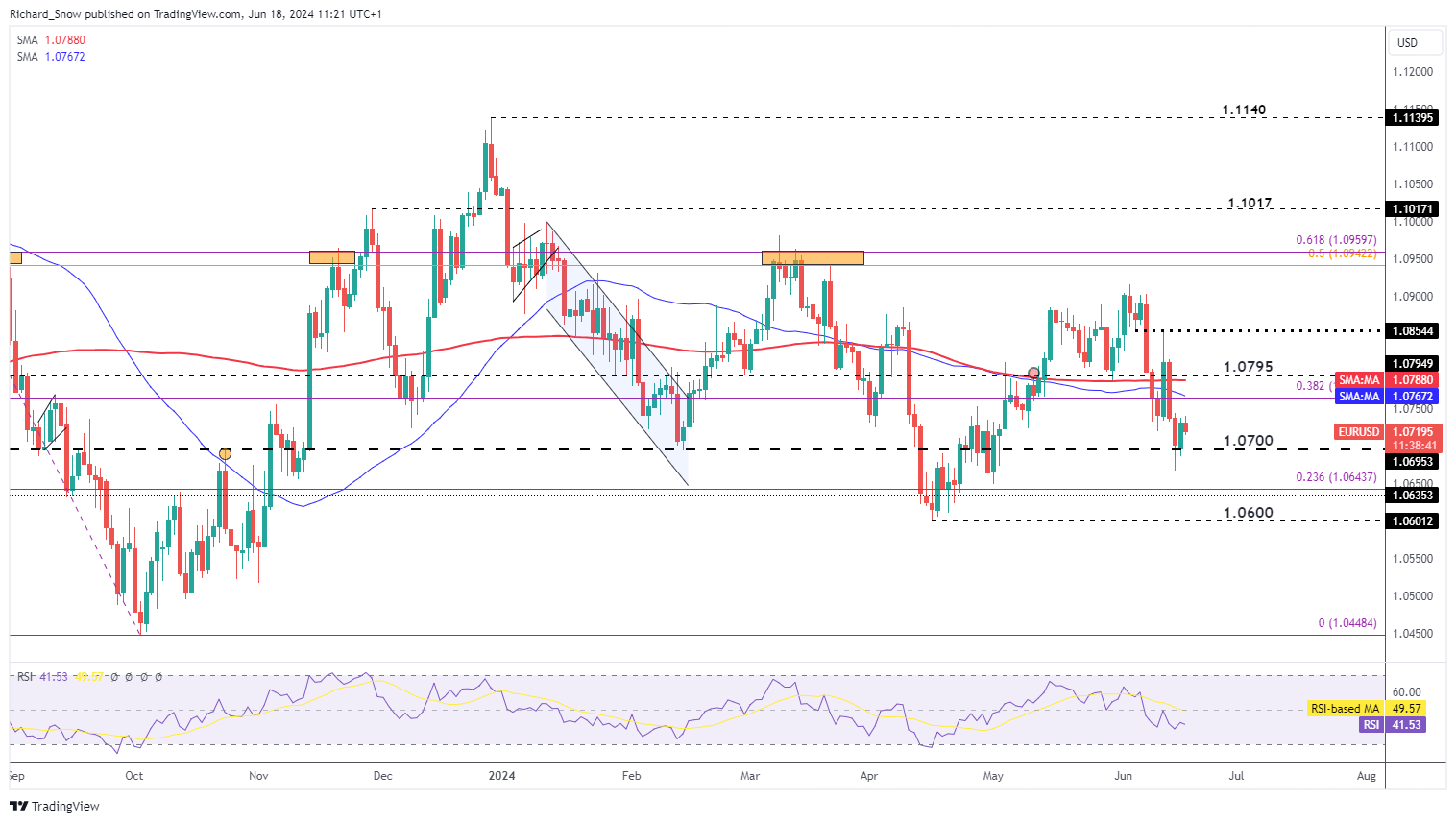

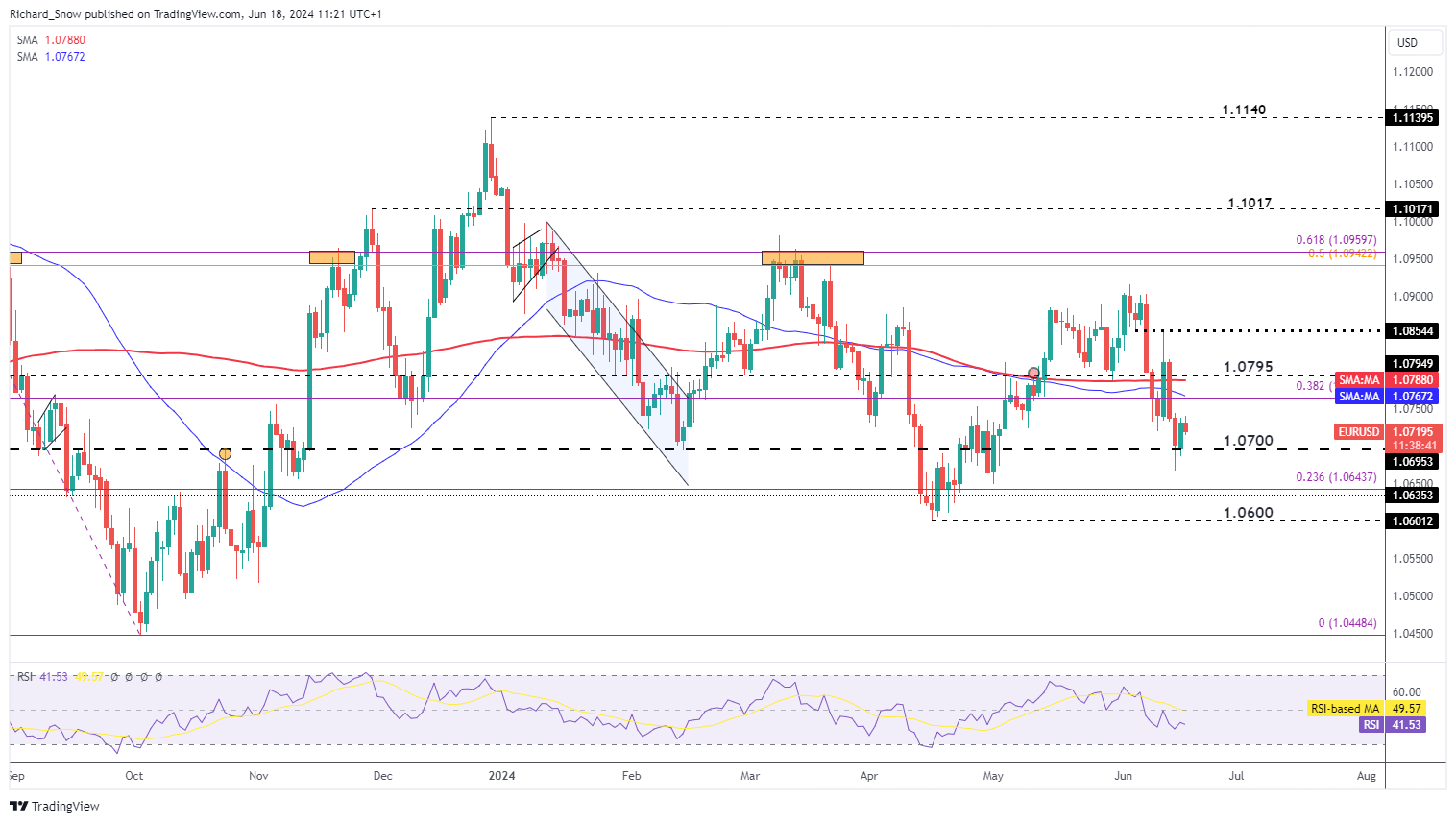

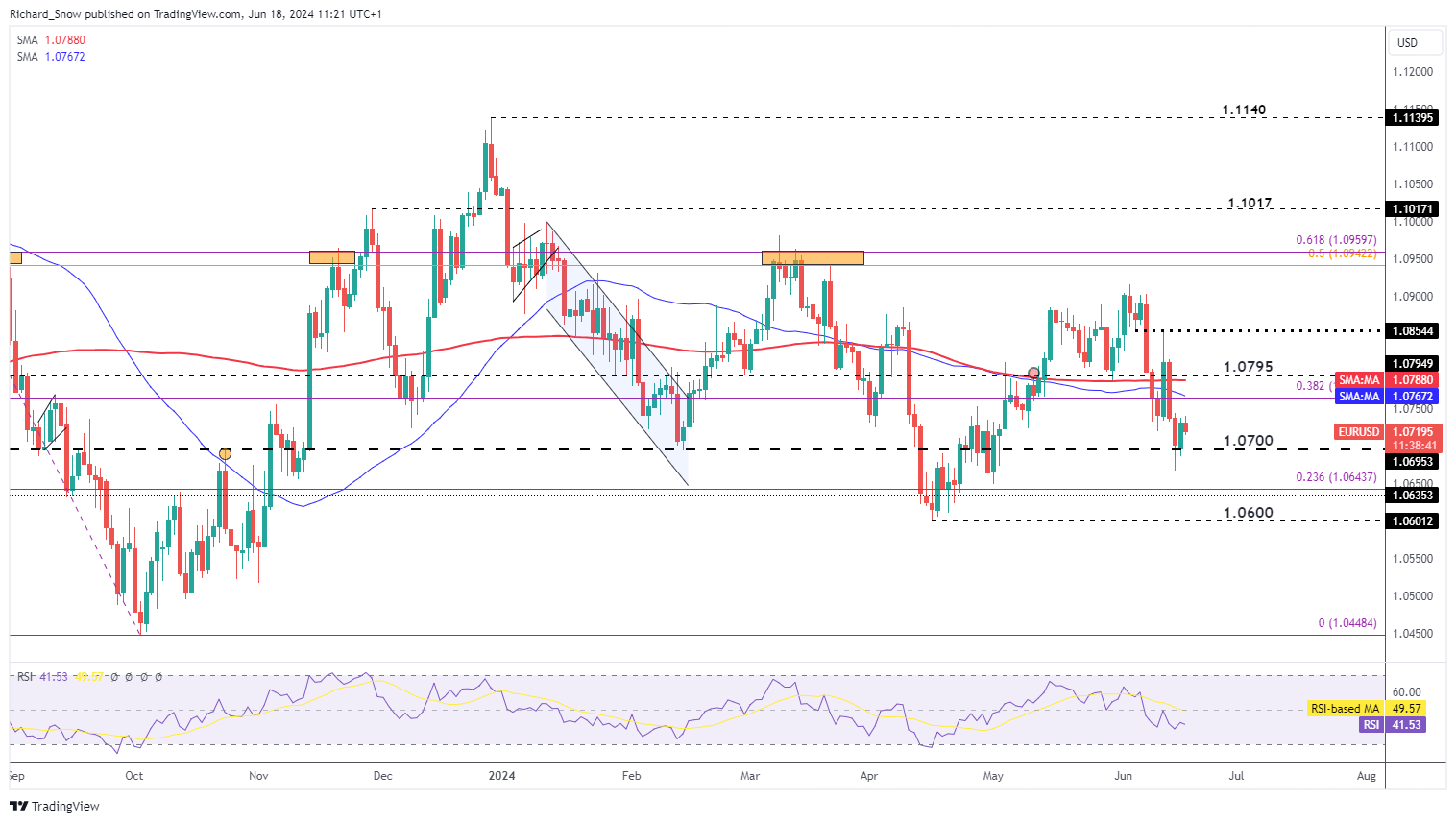

EUR/USD Fails to Capitalize on Monday's Reprieve, Downside Risks Persist

With last week’s top tier US data and the

FOMC

out of the way, the focus returns to Europe and France in particular. The campaign effort is in full swing ahead of the first round of parliamentary elections on the 30th of this month where representatives across the entire political spectrum campaign for votes.

The resounding rise in popularity for Marine Le pen’s National Rally party in the European elections has spooked markets ahead of the snap election. Markets seek stability and certainty and broadly view the Eurosceptic National Rally as an unpredictable force weighing on European bond markets currently.

French-German spreads reveal a notable risk premium that has been applied to riskier nations with higher debt loads like Italy and France, while investors have piled into safer German bonds. A sell-off in periphery nations’ bonds tends to be followed by a weaker

euro

– something to monitor as France head to the voting booths.

French-German 10Y Bond Spread (Risk Gauge)

Source: TradingView, prepared by

Richard Snow

Just yesterday the ECB’s Chief Economist Philip Lane characterised the recent move in the bond market as ‘repricing’ and not being in the world of ‘disorderly market dynamics’. The ECB unveiled a new tool to counter any unwarranted fragmentation in the bond market in 2022 when it began raising interest rates. It could be deployed to purchase bonds from qualifying member states in the event borrowing costs spiralled out of control, subject to fiscal and other conditions. France currently has a debt to

GDP

ratio above 110%, more than the EU proposed 60% which may complicate whether France qualifies for the assistance should spreads spiral out of control.

Source: IMF, Financial Times

On Monday the pair attempted to lift off the 1.0700 level but momentum has already come into question as risks to the downside remain. Price action trades below the 200 simple moving average and appears on course for a retest of 1.0700. The major level of support appears at 1.0600 and potentially even 1.0450 – the low of the major 2023 decline.

Despite a slight uptick in May, EU

inflation

data has been declining steadily as the ECB contemplate when it may be appropriate to cut interest rates again. Earlier today, ZEW economic sentiment disappointed expectations of 50, coming in at 47.5 (a slight improvement from last month’s 47.1). Inflation expectations were noted for having increased on the back of the slightly hotter May print.

EUR/

USD

Daily Chart

Source: TradingView, prepared by

Richard Snow

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in EUR/USD's positioning can act as key indicators for upcoming price movements.

Euro (EUR/USD) Analysis

Will the ECB Step in to calm widening bond spreads considering France's debt load?

EUR/USD Attempts to Hold 1.0700 but Downside Risks Remain

Change in

Longs

Shorts

OI

Daily

-11%

16%

-1%

Weekly

-19%

15%

-7%