British Pound, FTSE Steady After Labour Landslide, US NFPs Now Key

GBP/USD

and

FTSE 100

Analysis and Charts

For all market-moving economic data and events, see the

FB Finance Institute

The Labour Party will be handed the keys to No.10 Downing Street later this morning after winning the UK general election by a record margin. With only a handful of seats still to be declared, Labour has already won 410 of the 650 seats available, over 200 more than at the last election in 2019. The incumbent Conservative party are currently polling just 119 seats, down 248 seats from the previous election. While Labour was expected to win the election by a large margin, the Conservative rout, including the loss of many of the parties ‘big hitters’ is seen as a major shift in UK politics.

UK asset markets have been pricing in a large Labour majority ever since the general election was called and today’s lacklustre opening moves reflect this. The

British Pound

is barely changed against a range of other currencies, while the FTSE 100 is currently around 0.2% stronger. Financial markets like political certainty and this will likely shore up markets ahead of any major policy announcements.

Charts using TradingView

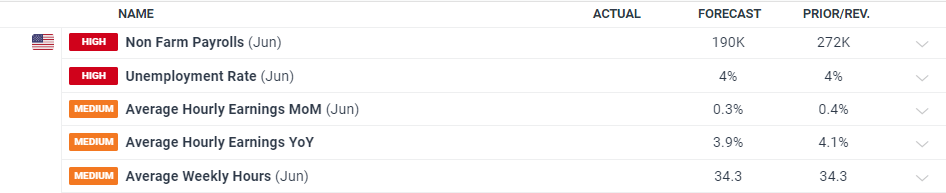

Later in today’s session, the latest US Jobs Report (NFPs) will be released, a monthly data point that is closely watched across the market. The US Labor Department is forecast to 190k new jobs created in June, down from a hefty 272k seen in May. So far this year, three of the first four employment reports have seen their initial estimate revised lower, while last year eight out of the 12 initial estimates were revised lower.

Nonfarm Payroll Employment - Revisions

The

US dollar

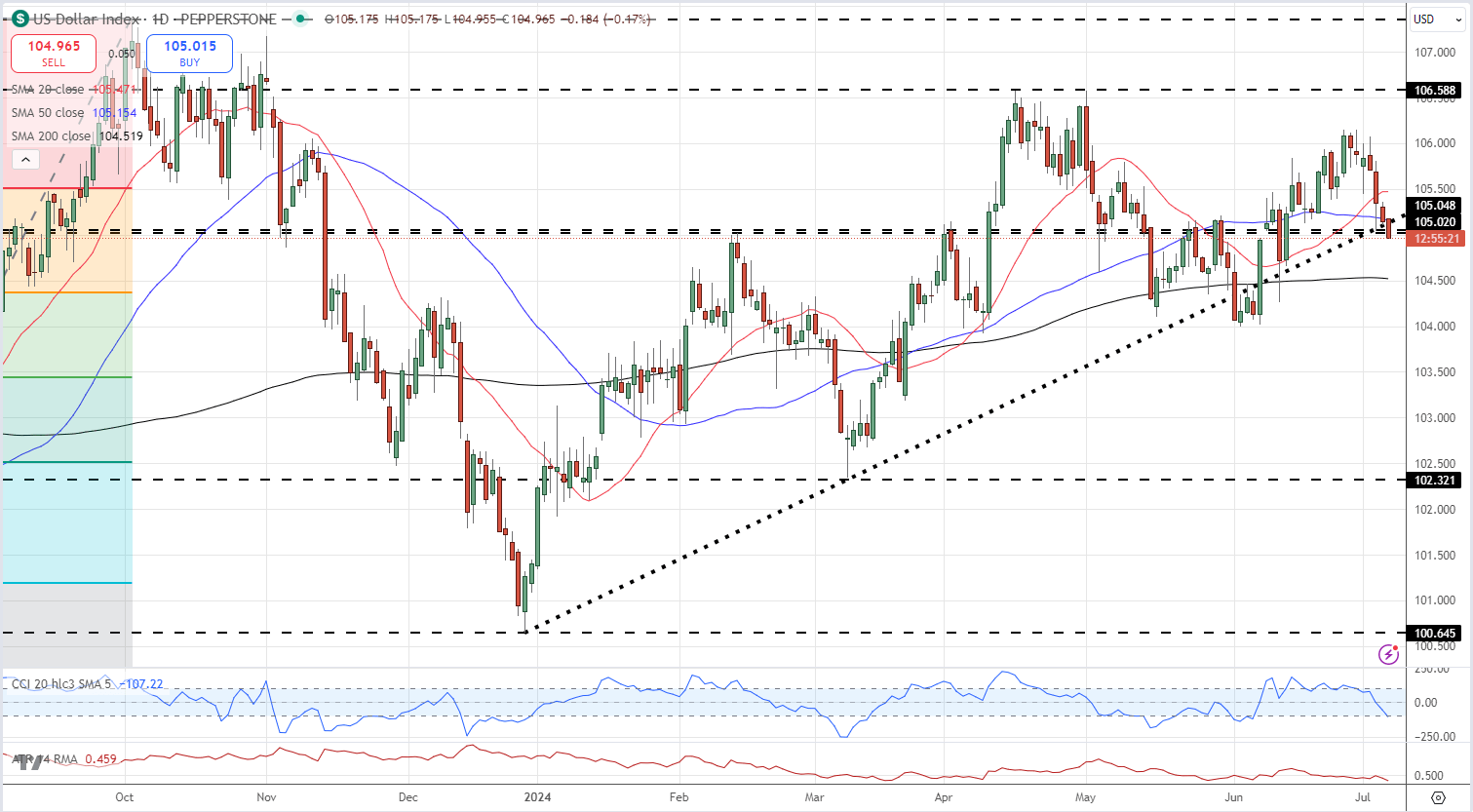

index is currently testing trend support, a prior swing high, and both the 20- and 50-day simple moving averages. A lower-than-expected NFP reading today could see the DXY test the 200-dsma just above 104.50.

What is your view on the

British Pound and the FTSE 100

– bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter

@nickcawley1

.

British Pound, FTSE, US NFPs

GBP/USD Daily Price Chart

FTSE 100 Daily Price Chart

US Dollar Index Daily Chart