Euro (EUR/USD) on Edge After Surprise French Election Result

Euro

(

EUR/USD

) Analysis and Charts

You can download our brand new Euro Q3 Technical and Fundamental Forecast below:

The French election resulted in a shock this weekend and left French financial markets vulnerable in the coming weeks. Many anticipated a strong showing from the far-right National Rally (RN) party, however, a left-wing coalition, the New Popular Front made significant gains and gained the most seats in the National Assembly. President Emmanuel Macron's centrist alliance, Ensemble, underperformed expectations but still beat the RN into second place.

Projected seat distribution in the 577-seat French National Assembly is:

The result has led to a hung parliament, meaning no single party or coalition has an outright majority. This hung parliament will likely lead to challenges in governance, as Macron's party will need to form alliances or negotiate with other parties to pass legislation. The leader of the New Popular Front, Jean-Luc Melenchon, has already said that the French prime minister must resign and that the

NFP

be given the mandate to govern. This political instability will leave French financial markets, and the single currency, vulnerable in the weeks ahead.

French asset markets are unchanged to marginally lower in early trade. The

CAC 40

is trying to push higher, but further gains may be limited as traders wait for further news on the new government's composition.

French borrowing costs remain elevated and may push higher still. New Popular Front leader Melenchon has already said that he will bring down the French pension age to 62, from 64, while he will also increase the minimum wage. Additional spending will need to be funded and French bond yields are set to move higher still.

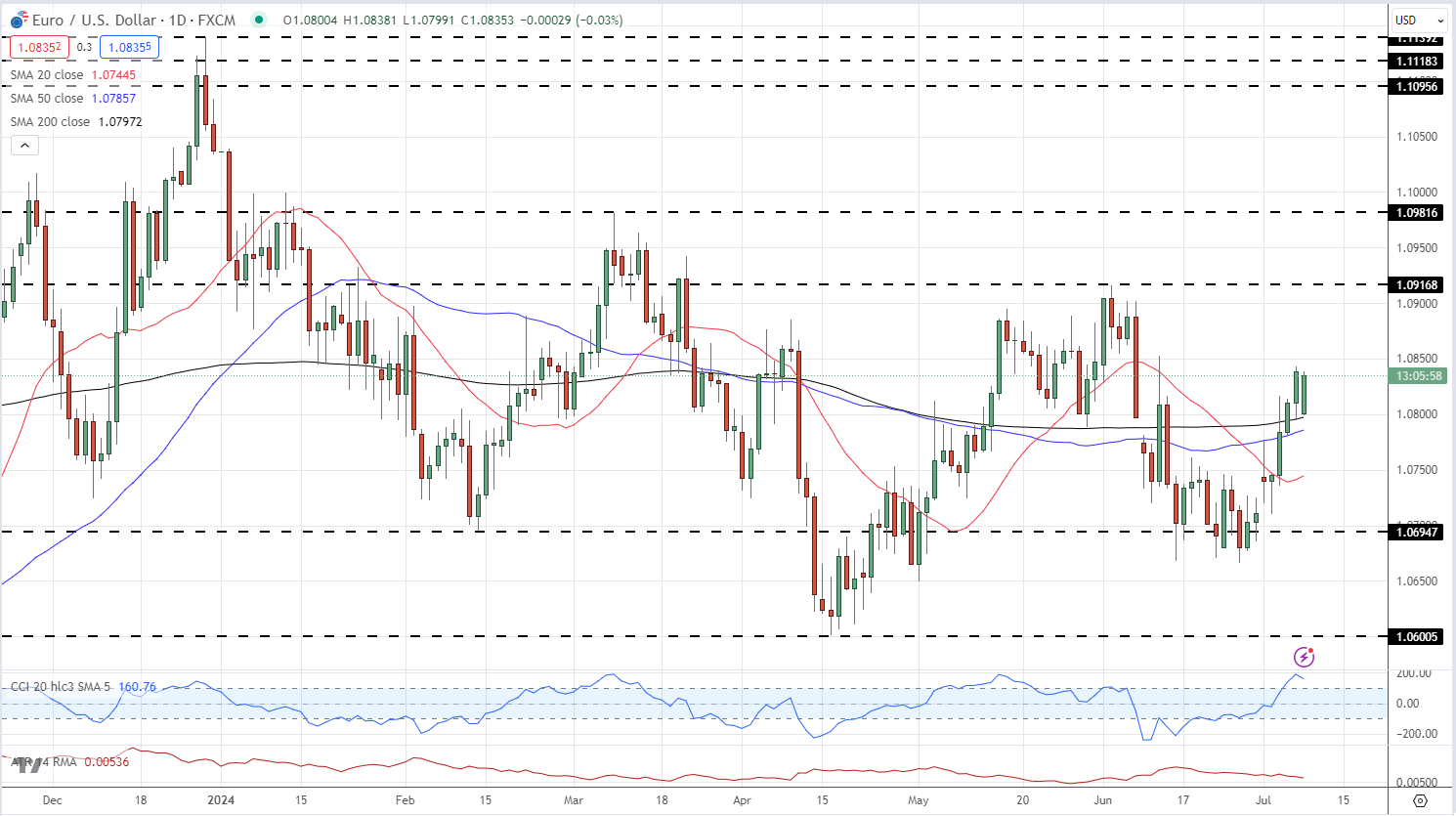

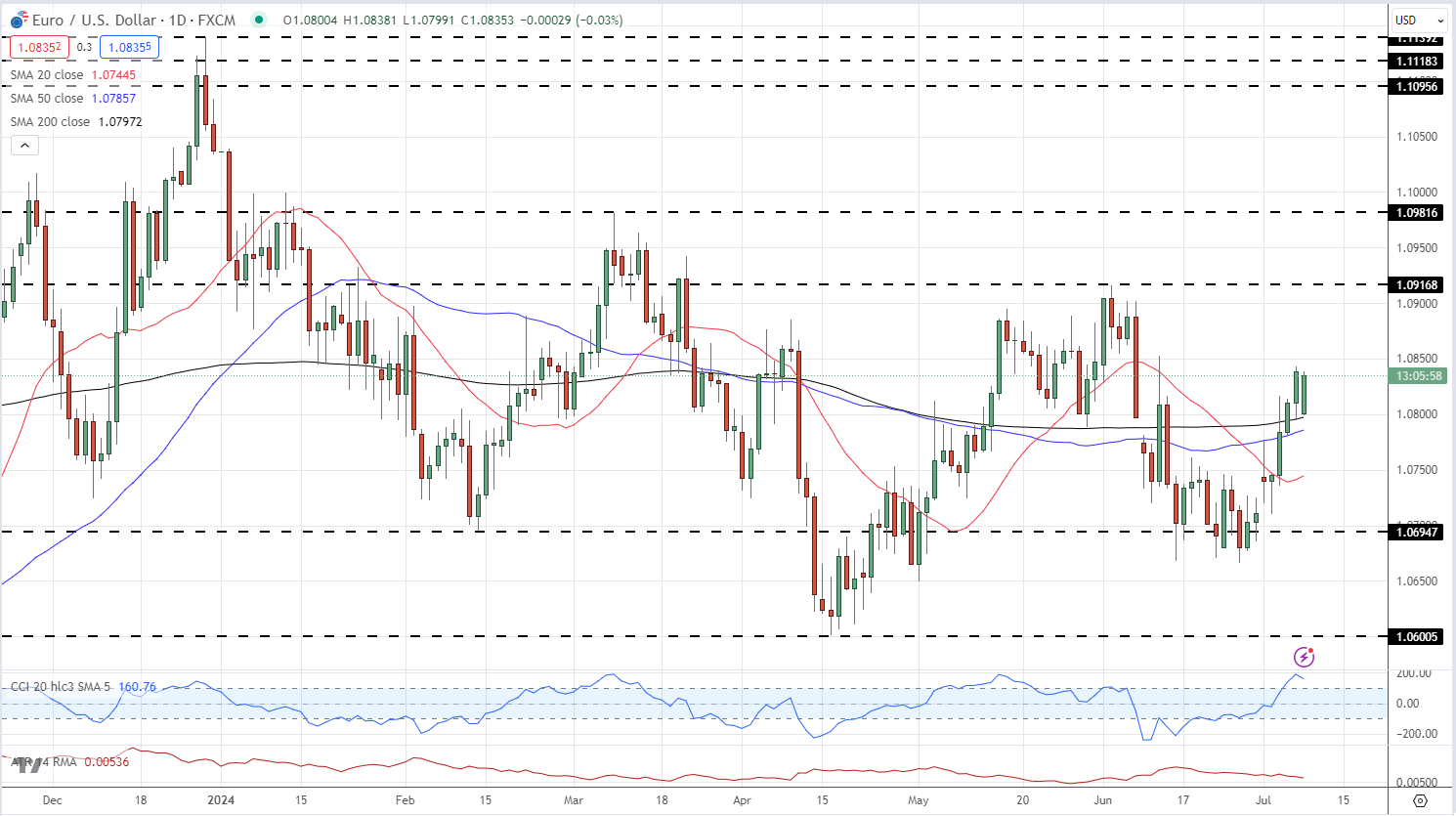

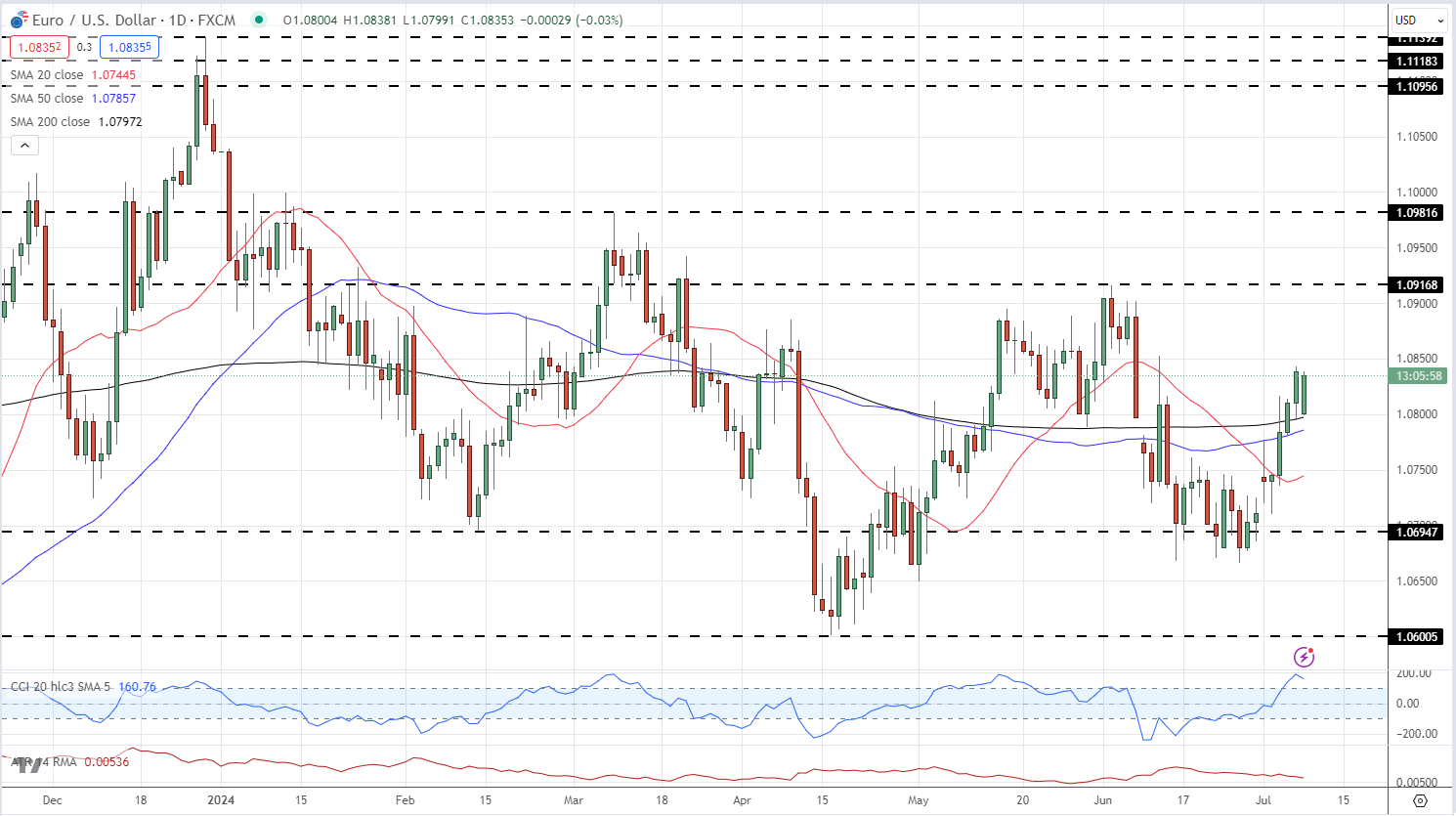

The Euro is relatively calm post-election and is keeping hold of last week’s gains. The Euro is also benefitting from the

US dollar

weakness and a period of calm in the days ahead could see the single currency drift back towards 1.0900 against the US dollar.

All charts using TradingView

Retail trader data 36.57% of traders are net-long with the ratio of traders short to long at 1.73 to 1.The number of traders net-long is 9.45% lower than yesterday and

35.06% lower than last week

, while the number of traders net-short is 5.37% higher than yesterday and

53.85% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/

USD

prices

may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on the

EURO

– bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter

@nickcawley1

.

CAC 40 Daily Chart

French 10-year Bond Yield

EUR/USD Daily Price Chart

Change in

Longs

Shorts

OI

Daily

15%

6%

9%

Weekly

-22%

38%

7%