US Dollar Slumps After Inflation Eases Further - Stocks, Gold, and Silver Rally

For all high impact data and event releases, see the real-time

FB Finance Institute

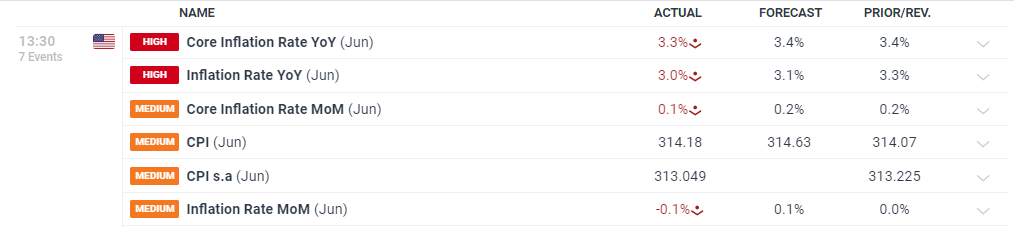

The US dollar index fell by nearly half a point after the latest US CPI showed inflation eased by more than forecast. Headline inflation y/y fell to 3.0% from 3.3% in May, while core inflation y/y fell to 3.3% from 3.4%. Core inflation m/m fell to 0.1% from a prior month’s reading of 0.2%.

Markets are now showing an 87% chance of a 25 basis point interest

rate cut

at the September 18th

FOMC

meeting.

The US dollar index fell around 40 pips on the news and continues to sell off. The DXY is now closing in on the recent low prints around 104.00 made in early June

US indices have now turned positive pre-open with the

Nasdaq

100 and the

S&P 500

currently showing gains of 0.3% on the session.

Gold is back above $2,400/oz. for the first time since late May, and there is little resistance left on the daily charts until the recent high at $2,450/oz. comes into play.

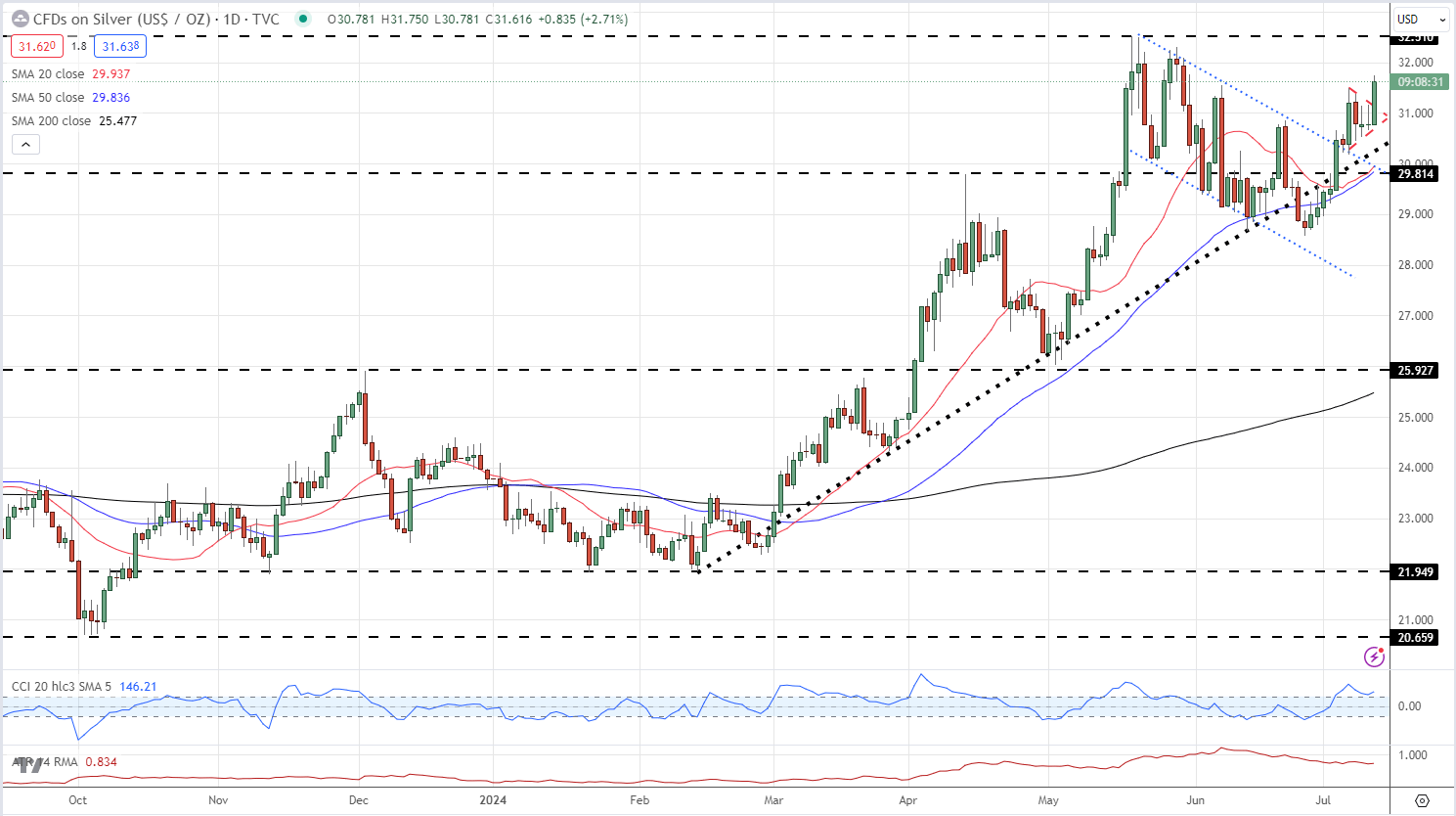

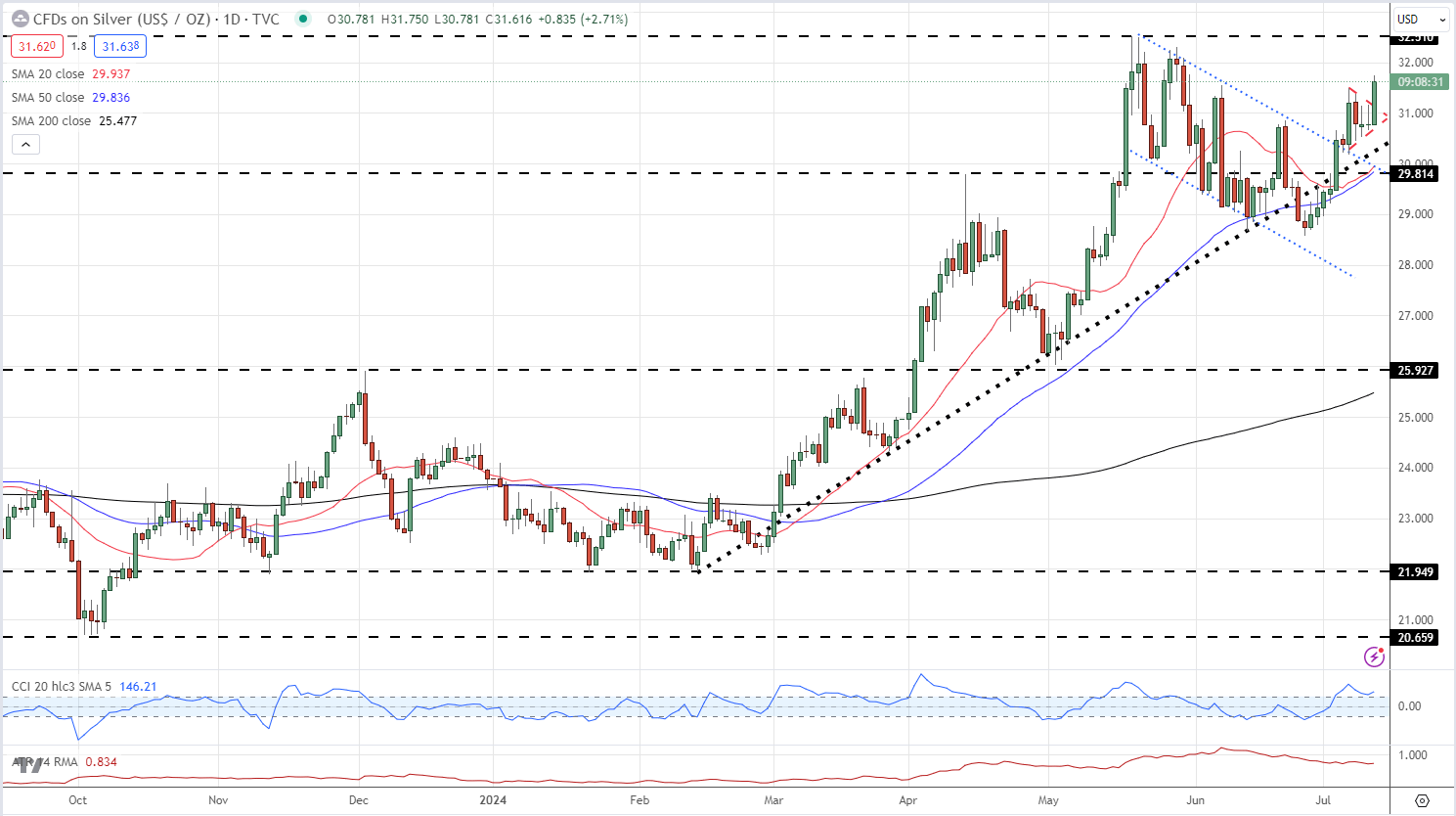

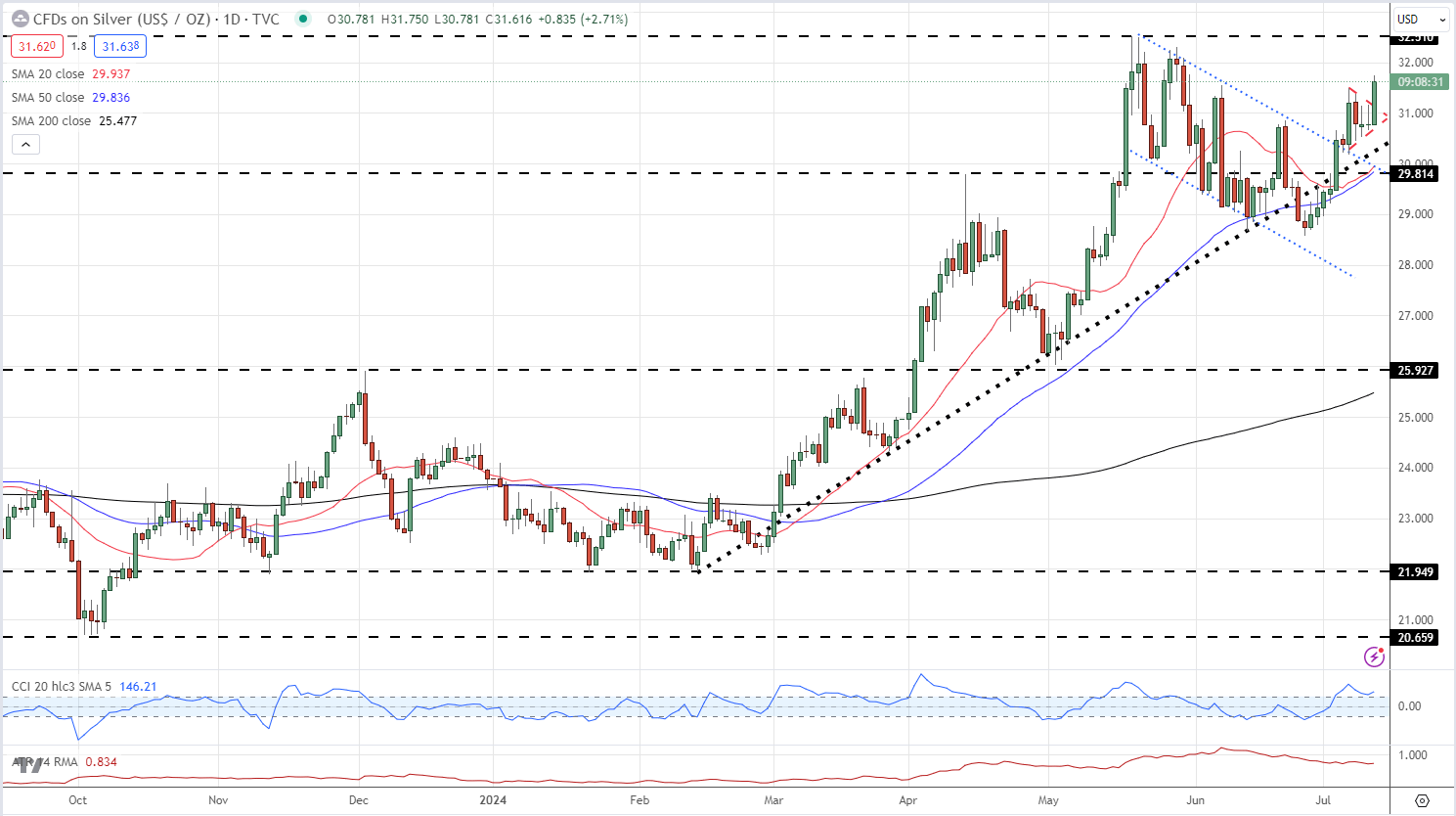

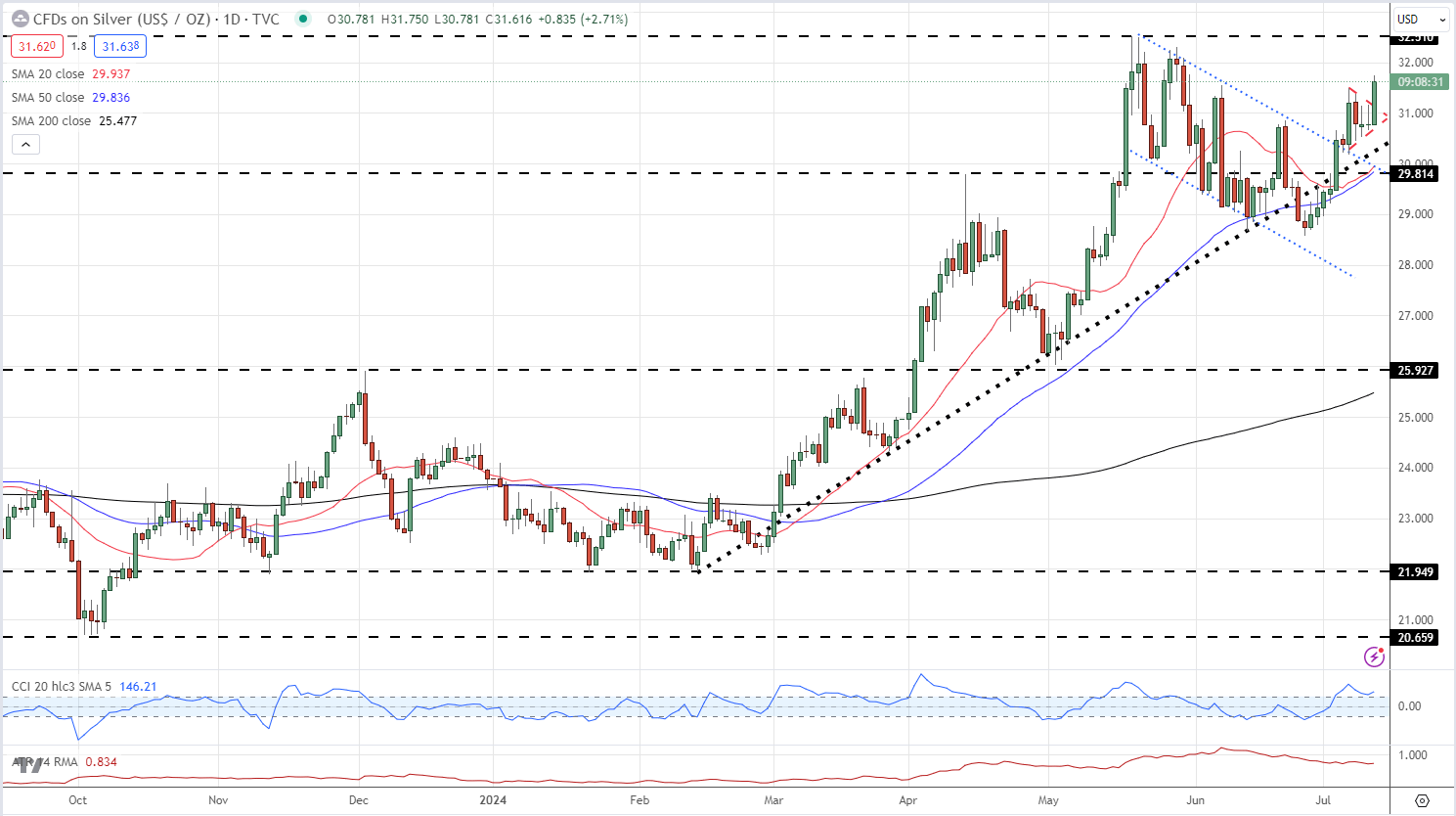

Silver

outperforms gold and is over 2.5% higher after the data release. Silver has also broken out of the recent daily pennant pattern, confirming a bullish outlook and a test of $32.50/oz.

Silver – Bullish Technical Patterns on the Daily Chart

US Dollar, Stocks, Gold, and Silver Analysis and Charts

US Dollar Index Daily Chart

Gold Daily Price Chart

Silver Daily Price Chart