Retail Sentiment Analysis – GBP/USD, EUR/USD, and AUD/USD Updates

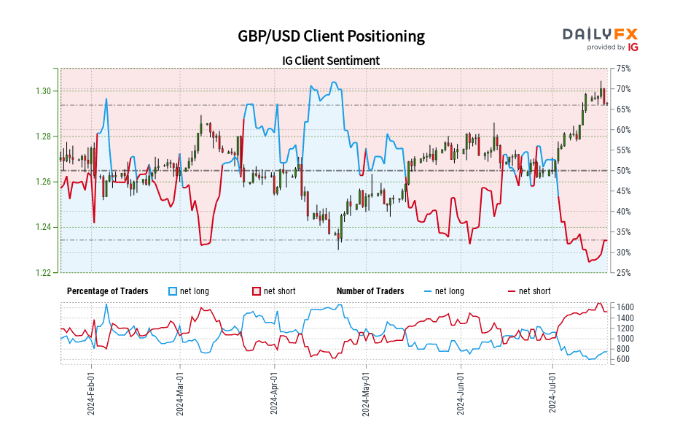

Recent retail trader data indicates a net-long position of 32.63%, with a short-to-long ratio of 2.07 to 1. Net-long traders have increased by 1.37% since yesterday and 13.89% from last week. Net-short traders have decreased by 4.09% since yesterday but increased by 1.06% from last week.

Our contrarian approach to market sentiment suggests potential continued

growth

in

GBP/USD

prices

, given the net-short position of traders. However, the reduction in net-short positions compared to yesterday and last week may indicate an impending downward trend reversal, despite the overall net-short stance.

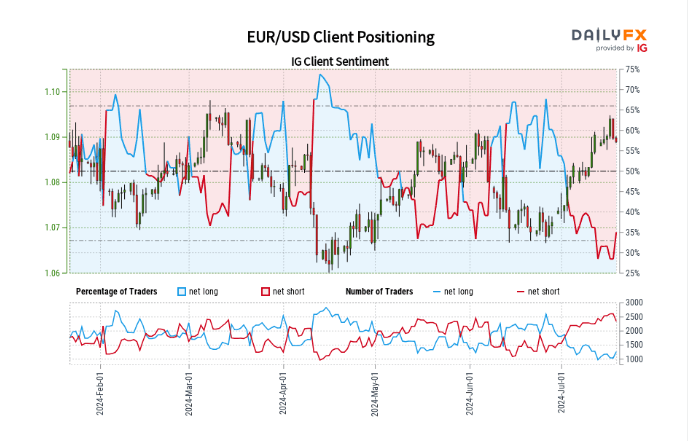

Retail trader data indicates 34.95% of traders are net-long, with a short-to-long ratio of 1.86 to 1. Net-long positions have increased by 20.13% since yesterday but decreased by 1.65% from last week. Net-short positions have declined 10.96% since yesterday but risen 3.60% week-over-week.

Given the net-short trader positioning, our contrarian approach to market sentiment suggests potential upward movement in

EUR/USD

prices. However, the reduced net-short stance compared to yesterday and the increased net-short position from last week present a mixed trading outlook for

EUR

/

USD

.

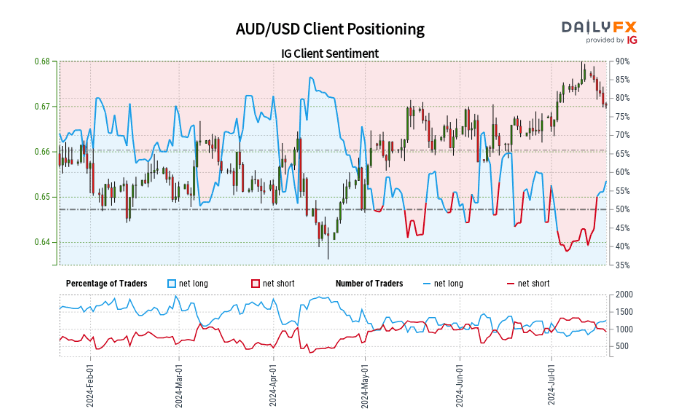

Retail trader data indicates 58.13% of traders are net-long, with a long-to-short ratio of 1.39 to 1. Net-long positions have increased 6.13% since yesterday and 28.51% from last week. Net-short positions have decreased 8.06% since yesterday and 22.21% week-over-week.

Our contrarian approach to market sentiment suggests potential downward movement in

AUD/USD

prices, given the net-long trader positioning. The increased net-long stance compared to both yesterday and last week reinforces a stronger bearish outlook for

AUD

/USD based on our contrarian trading bias.

Retail Sentiment Analysis – GBP/USD, EUR/USD, and AUD/USD

GBP/USD Retail Trader Data: Reversal Lower?

EUR/USD Retail Trader Data: Mixed Outlook

Change in

Longs

Shorts

OI

Daily

12%

-4%

2%

Weekly

32%

-5%

6%

AUD/USD Retail Trader Data: Bearish Bias