Retail Sentiment Analysis – Gold, US Oil, and DAX 40 Latest

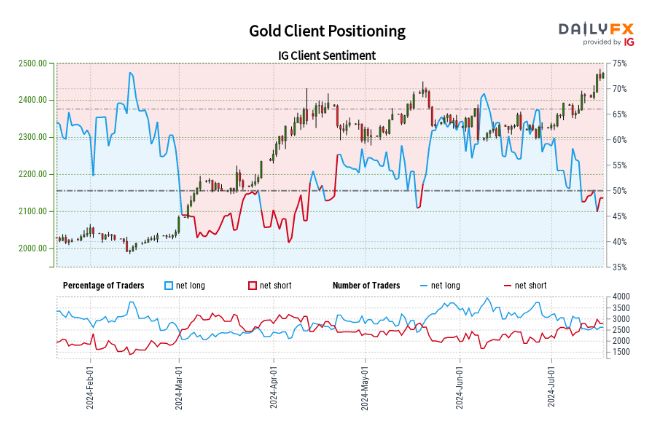

Recent retail trader data reveals a near-even split in market positioning, with 49.98% of traders holding long positions. The ratio of short to long traders stands at 1:1, indicating a balanced market sentiment.

Key points:

Our analysis typically adopts a contrarian stance to crowd sentiment. The slight bearish tilt suggests potential upward momentum for

gold prices

. However, the mixed short-term and long-term trends create an ambiguous trading outlook.

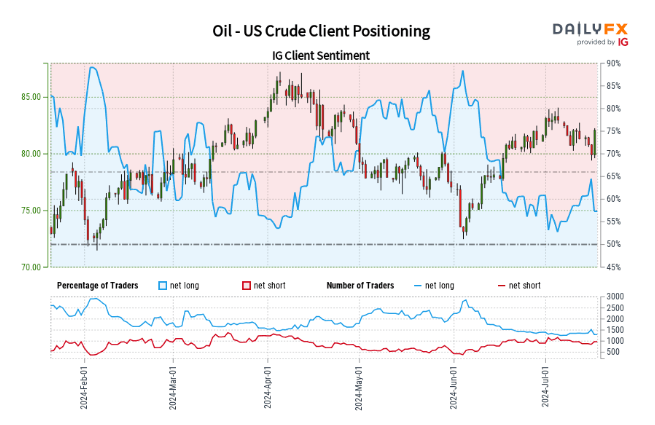

Recent retail trader data reveals a significant bullish bias in US

Crude Oil

positioning, with 57.35% of traders holding long positions. The ratio of long to short traders stands at 1.34:1, indicating a clear preference for upside potential.

Key points:

While our contrarian approach typically suggests bearish pressure when traders are net-long, recent shifts in positioning warrant closer attention. The decrease in long positions coupled with an increase in short positions may signal a potential upward reversal in

Oil

- US Crude

prices

.

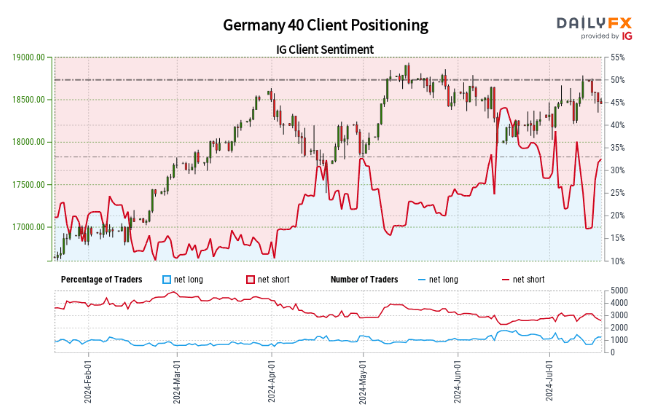

Recent retail trader data reveals a significant bearish bias in

Germany 40

positioning, with only 32.81% of traders holding long positions. The ratio of short to long traders stands at 2.05:1, indicating a clear preference for downside potential.

Key points:

While our contrarian approach typically suggests bullish pressure when traders are net-short, recent shifts in positioning warrant closer attention. The decrease in short positions coupled with a slight increase in long positions may signal a potential downward reversal in Germany 40 prices.

Retail Sentiment Analysis – Gold, US Oil, and DAX 40 Latest

Gold Retail Trader data: Mixed Signals Emerge

US Oil Retail Trader Data: Bullish Positioning Hints at Potential Reversal

Change in

Longs

Shorts

OI

Daily

8%

-20%

-3%

Weekly

6%

-19%

-4%

DAX 40 Retail Traders data: Bearish Positioning Hints at Potential Reversal