UK Inflation Remains Sticky; GBP/USD Sentiment Analysis

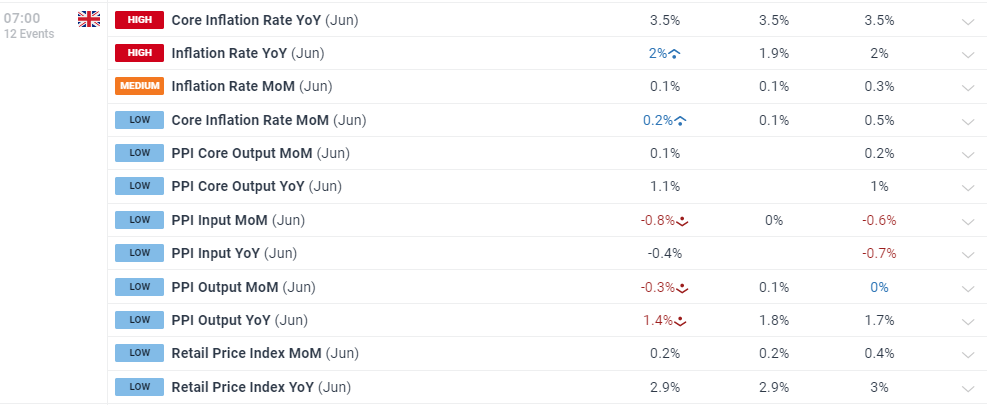

UK inflation was little moved in June with core y/y unchanged at 3.5%, while headline inflation remained steady at the Bank of England’s 2% target. According to the Office for National Statistics,

‘The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from restaurants and hotels, where prices of hotels rose more than a year ago; the largest downward contribution came from clothing and footwear, with prices of garments falling this year having risen a year ago.’

Consumer Price Inflation, UK: June 2024

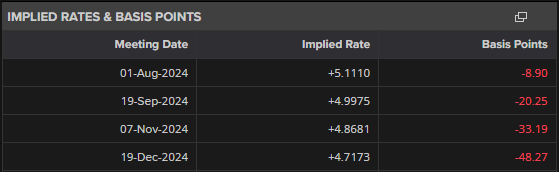

BoE rate

cut expectations moved after the data hit the screens, with analysts seeing sticky inflation paring back

rate cut

expectations. The first UK rate cut has been pushed back to September with two quarter-point cuts seen this year.

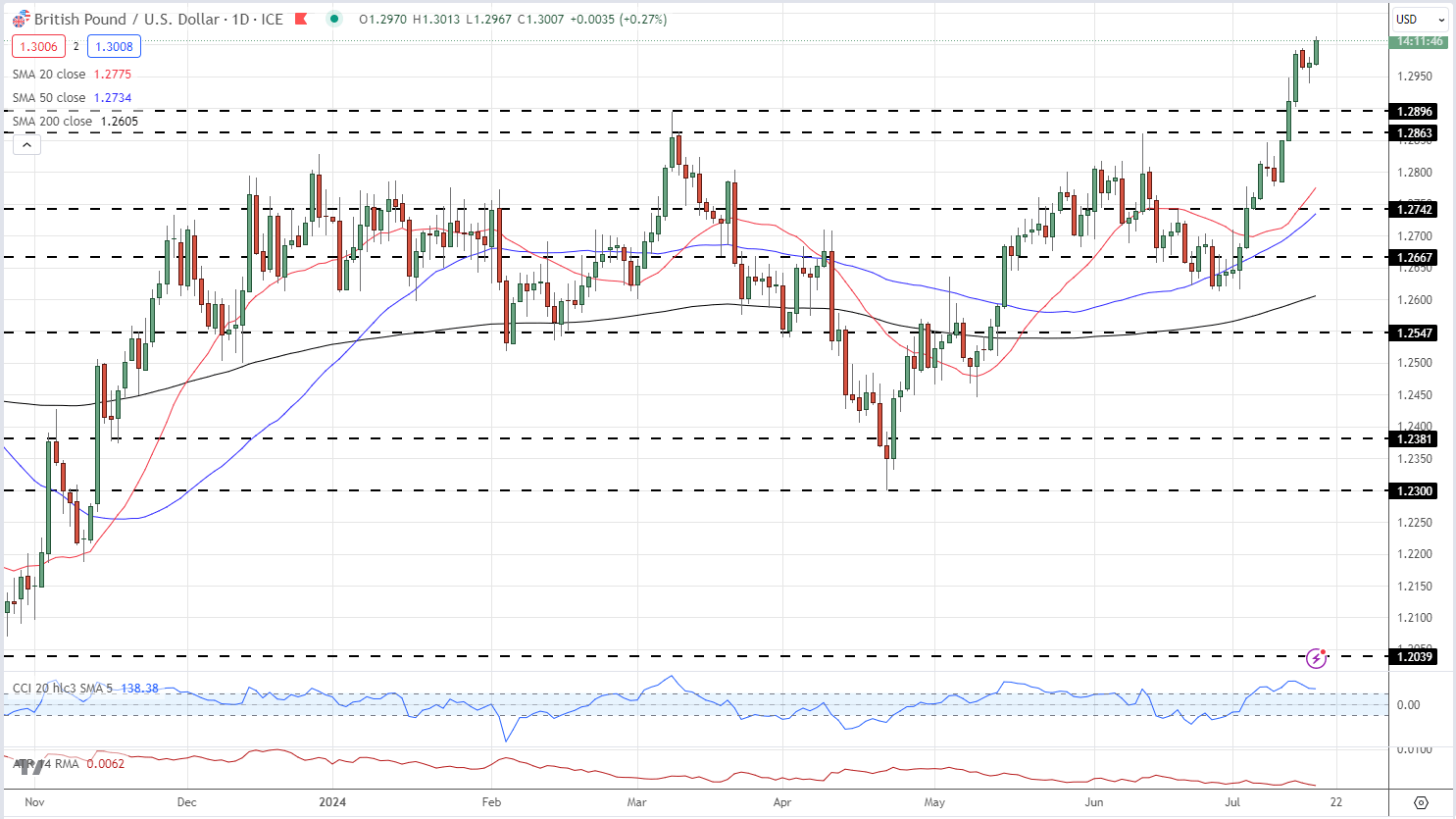

GBP

/

USD

moved higher after the data release and is back above 1.3000 for the first time since July 2023. UK 2-year gilt yields are back above 4% after trading at 3.97% yesterday, while

US dollar

weakness is also helping the pair move higher.

Current Positioning: The latest retail trader data reveals that 29.52% of traders are net-long on GBP/USD, with a short-to-long ratio of 2.39:1. This indicates a significant bearish sentiment among retail traders.

Recent Changes:

Contrarian Perspective: Adopting a contrarian view to crowd sentiment, the predominance of net-short positions suggests that GBP/USD prices may continue to rise. This approach is based on the principle that retail sentiment often contrasts with market movements.

What is your view on

the British Pound

– bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter

@nickcawley1

.

UK Inflation Remains Sticky; GBP/USD Sentiment Analysis

GBP/USD Daily Price Chart

GBP/USD Sentiment Analysis

Change in

Longs

Shorts

OI

Daily

6%

-7%

-3%

Weekly

26%

-7%

3%