Bitcoin (BTC), Ethereum (ETH) – Technical Outlooks

Bitcoin

(BTC),

Ethereum

(ETH) -

Prices

, Charts, and Analysis:

Bitcoin has been treading water for the last three weeks with little to suggest either a move higher or lower. The daily BTC/USD chart looks positive with all three simple moving averages in a bullish set-up and supporting a move higher, with a short-term series of higher lows and higher highs since the start of May adding to positive momentum. A break and open above $70k should quickly see $72k tested, leaving the ATH at $73,778 vulnerable. With demand from a range of global spot Bitcoin ETFs outpacing post-halving new Bitcoin supply, the medium-to-longer outlook for Bitcoin looks constructive.

Bitcoin Halving – What Does It Mean?

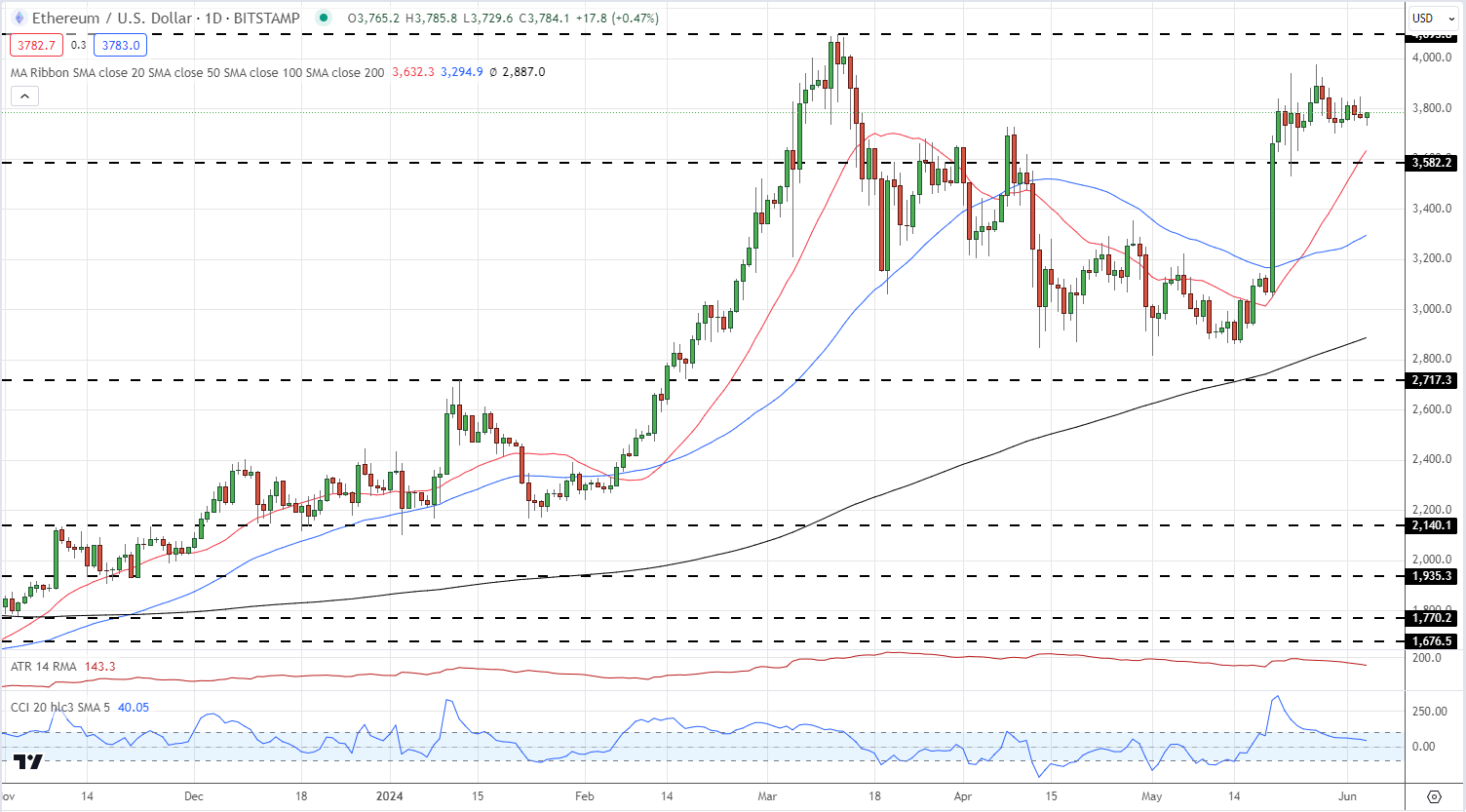

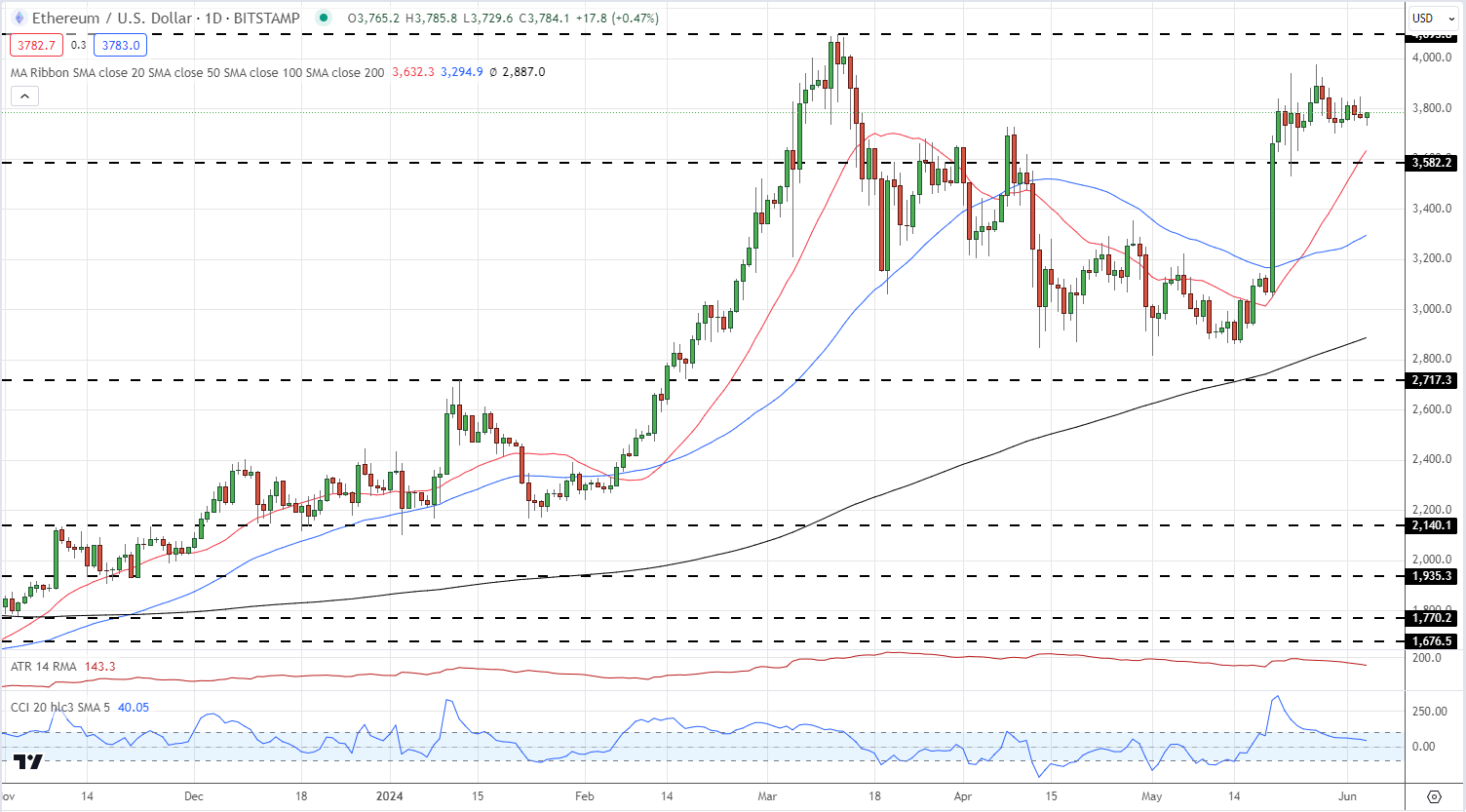

Recent SEC approval for a range of spot Ethereum ETFs has seen the second-largest cryptocurrency by market cap perform strongly since late May. The near 20% bullish candle on May 20th, and the subsequent period of consolidation, is setting up a rough bullish flag pennant, again pointing to higher prices. The March 12th high at $4,095 should be tested when the May 27th high at $3,974 is broken, leaving the November 2021 ATH at $4,860 the longer-term target.

Pennant Patterns: Trading Bearish and Bullish Pennants

All charts via TradingView

What is your view on

Bitcoin and Ethereum

– bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter

@nickcawley1

.

Bitcoin Daily Price Chart

Ethereum Daily Price Chart