US Dollar Weakens After Monthly Inflation Cools, Gold Gains Momentum

US Dollar

Weakens After Monthly

Inflation

Cools,

Gold

Gains Momentum

The US dollar slipped lower and gold picked up a small bid after the latest US PCE data hit the screens. Both the Core and Headline y/y PCE came in line with expectations, and March’s readings, at 2.8% and 2.7% respectively, but the m/m Core reading came in marginally below expectations and last month’s reading. Monthly personal income and spending both fell. It is a slightly positive release but unlikely to move any rate-cut expectations.

For all economic data releases and events see the

FB Finance Institute

The US dollar index fell after the inflation release and is being propped up by the 200-day simple moving average at 104.45 ahead of the 38.2% Fibonacci retracement level at 104.37.

Chart by TradingView

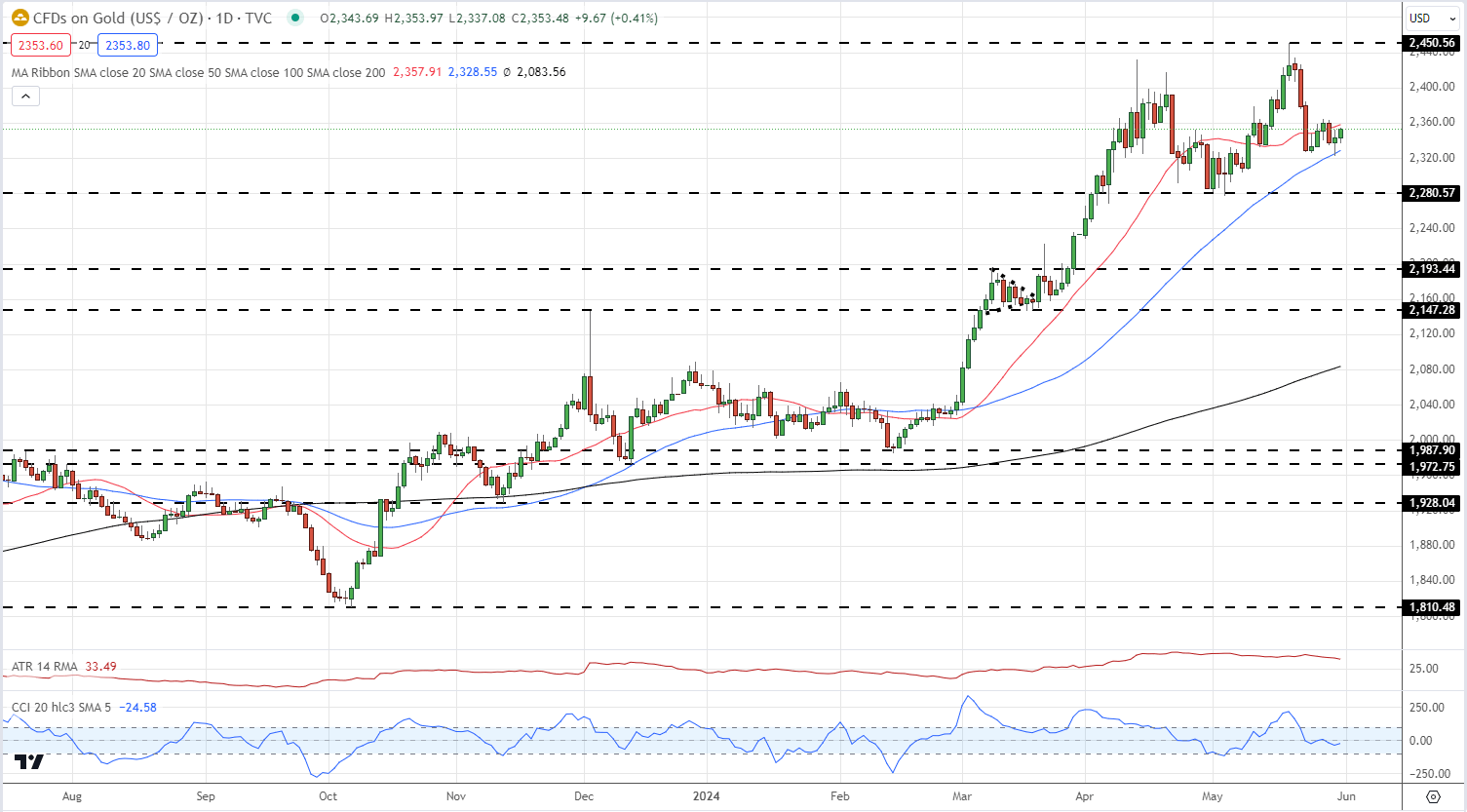

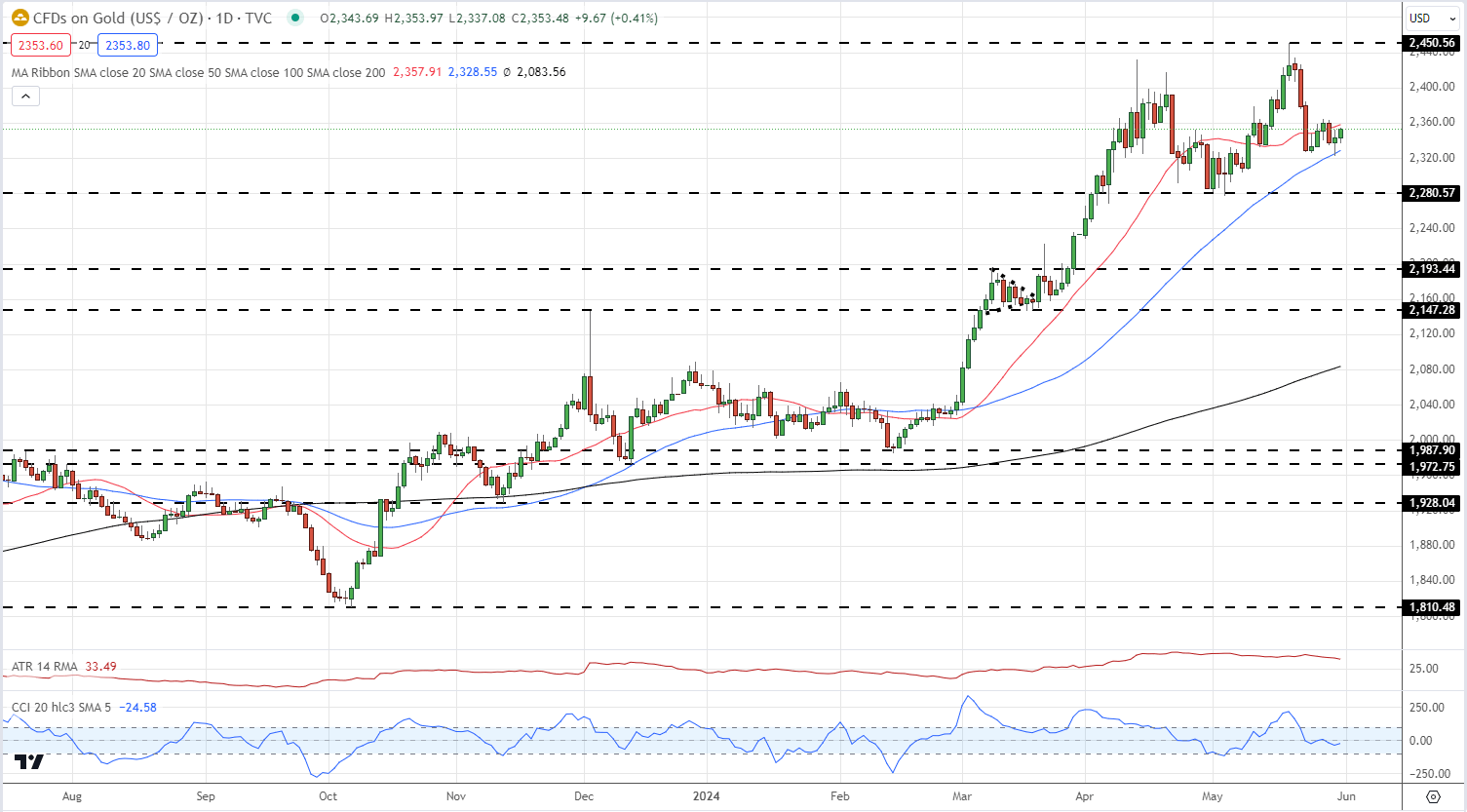

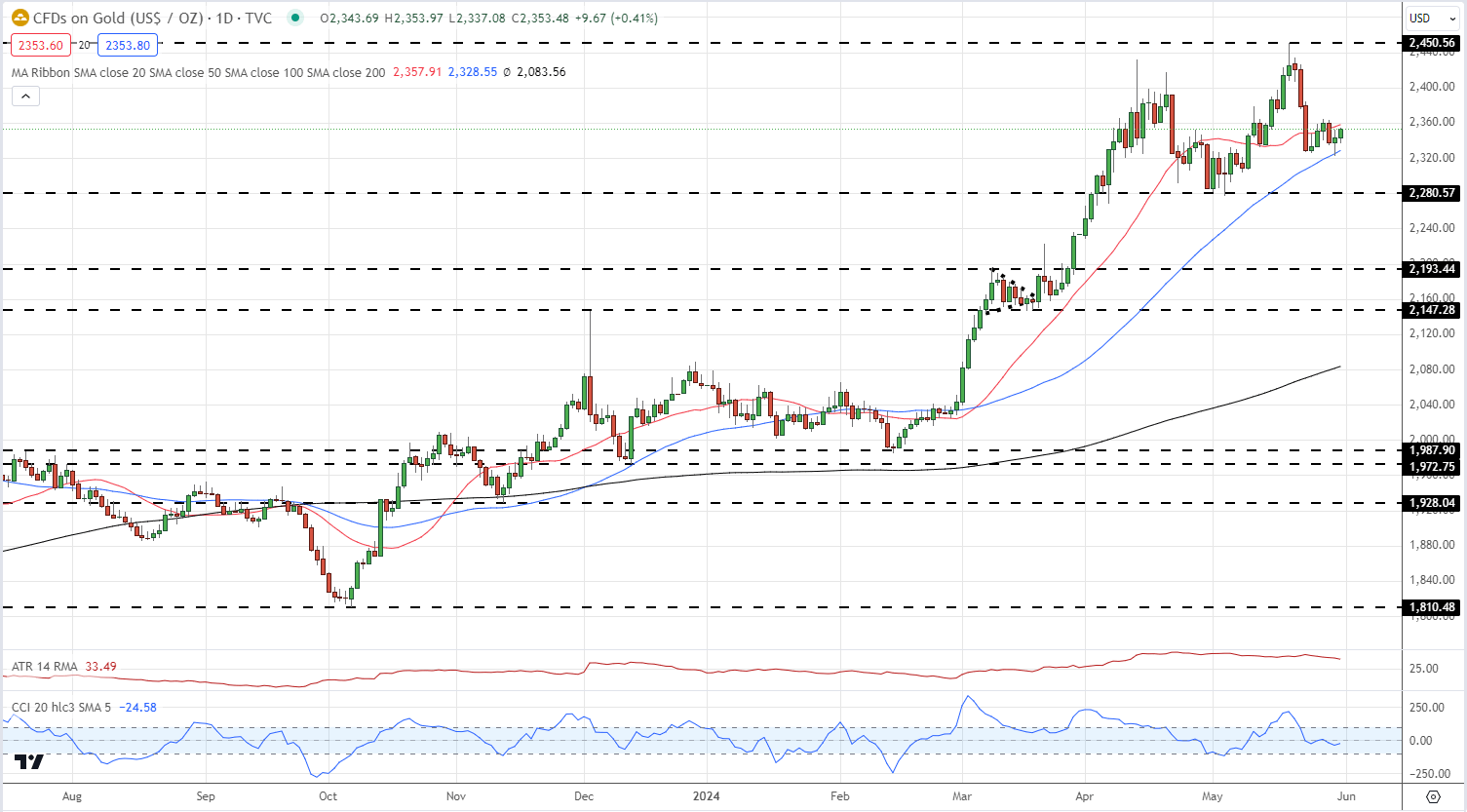

Gold is around 0.50% higher at $2,353/oz. and eyes near-term resistance from the 50-day simple moving average at $2,358/oz. Above here lies $2,400/oz.

Gold Daily Price Chart

US Dollar Index Daily Chart