US Crude Oil Bounces Back But Looks Rangebound Before OPEC’s June Meet

Crude Oil Prices

rose a little on Thursday, recovering from their Federal-Reserve- induced slide in the previous session, but the market remains rangebound and looks likely to stay that way before June’s meeting of key producers.

The Organization of Petroleum Exporting Countries and its allies is scheduled to get together in early June. This could prove supportive for prices if current voluntary production cuts are extended, but the market understandably perhaps wants to wait to see what the group does.

This may explain why oil prices have failed to match the recent vigor of both

natural gas

and industrial metals.

Energy demand overall remains very much linked to

monetary policy

expectations, and especially those in the United States. While the market still thinks it will get at least one rate cut out of the Fed this year, Wednesday’s release of minutes from the last monetary policy meeting found rate setters prepared to raise borrowing costs further should inflation prove sticker than expected. Now on one level this is obvious, and merely a reiteration of the Fed’s mandate. However, in a market so attuned to any policy cues, any hint that rates might remain ‘higher for longer’ was enough to knock the market.

Energy Information Association data showed a 1.8-million-barrel increase in US crude stockpiles last week, compared with a 2.5-million-barrel drawdown the week before. This also weighed on a market that has long fretted the possibility of strong supply meeting indifferent demand.

Friday will bring a number of key scheduled data points including US durable goods orders, the University of Michigan consumer sentiment snapshot and German economic

growth

. Closer to the oil market will be the US operating rig count from Baker Hughes.

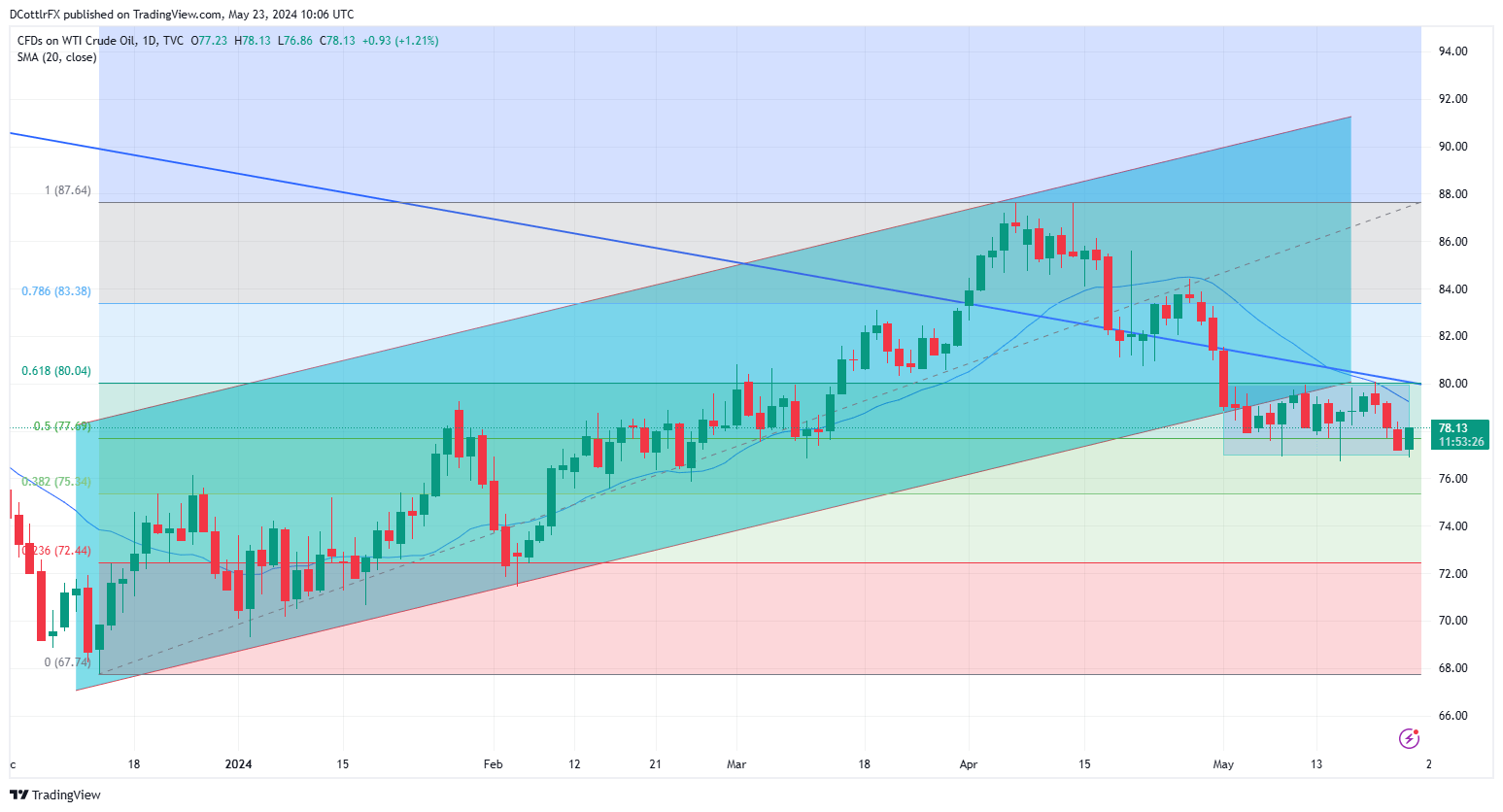

West Texas Intermediate Daily Chart Created Using TradingView

Learn about the nuances of trading oil by developing an in-depth understanding of the effects of geopolitical tensions, demand and supply, as well as the state of the global economy:

Prices have clearly been rangebound since the start of this month when they broke below the previously dominant uptrend channel from the lows of mid-December.

The medium-term downtrend from June 2022 continues to cap the market, but it is getting closer to current levels and now provides resistance at $79.73. The 20-day moving average also provides near-term resistance at $79.11.

Retracement support at $77.69 still looks important. The market has been below that mark this month but has shown no inclination to remain there for long on a daily-closing basis.

The current range lies between $80.09 and $76.89. This seems very likely to hold at least into the OPEC meeting next month and perhaps beyond.

IG’s own data finds the market overwhelmingly long at present, but that may simply be accounted for by the fact that prices are closer to the bottom of that range.

--By David Cottle for DailyFX

Crude Oil (WTI) Main Talking Points and Analysis:

Crude Oil Prices Technical Analysis