Will the public miss WH Smith if it disappears from the UK high street?

YouGov ’s chief executive Steve Hatch takes a closer look at the data behind the biggest stories in business. Here, he looks at the future of WH Smith.

News broke last week that

WH Smith was looking to sell its UK high street stores

. The company told the London Stock Exchange that it intended to become a “more focused global travel retailer” and noted that three-quarters of its revenue and 85 per cent of its trading profit came from this side of the business. Hobbycraft owner Modella Capital is reported to be among its potential suitors.

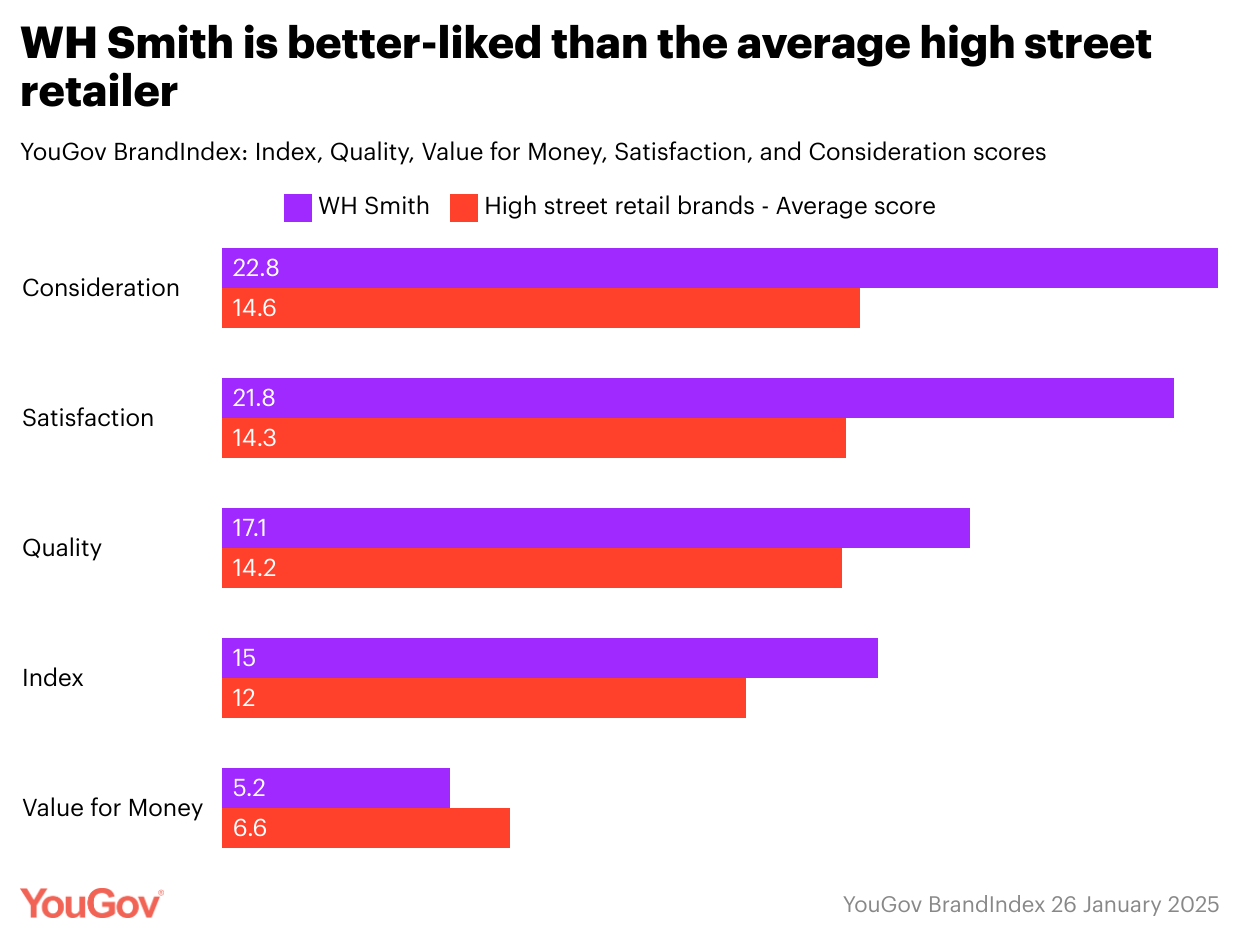

If the more than 230-year-old retailer does disappear from the high street, the public may miss it. Data from YouGov BrandIndex – which asks consumers questions about a range of brands every day – shows that Index scores, which track overall brand health, are at 15.0 for WH Smith compared to an average of 12.0 for UK high street retailers. With Impression scores (a measure of sentiment) at 22.0 next to a sector average of 15.9, it’s also better-liked.

WH Smith is generally perceived as better quality than the average high street retailer – scores for this measure are at 17.1 compared to an industry score of 14.2 – and it’s a similar story with Customer Satisfaction (21.8 vs. 14.3). It underperforms the sector a little when it comes to Value for Money (5.2 vs. 6.6) – some headlines have described the chain as a “rip off” – but Consideration scores remained healthy (22.8 vs. 14.6 for the sector).

If WH Smith becomes the latest UK brand to leave the high street, it will be in comparably unusual circumstances. Unlike Debenhams, Ted Baker, Woolworths, or others, the retail business remains – in the company’s own words – “profitable and cash-generating”, a victim of a strategic shift towards airports and train stations instead of outright commercial failure. Our data shows that it also remains broadly well-liked, despite having sometimes been a target for columnists. If WH Smith does leave the high street, consumers may mourn its loss.