Oil Price Update: Israeli Troops Withdraw from the South, Peace Talks Underway

Israeli soldiers have been called back from Southern Israel after sparking outrage over the recent aggression that killed seven aid workers. The US sent a particularly strong message that civilians need to be protected and that Israel needs to allow more aid into the besieged territory.

Hammas insist on a full withdrawal of IDF soldiers, something Israel in not prepared to facilitate, and it is not yet known whether the partial withdrawal of soldiers is some sort of compromise ahead of peace talks or a way to appease global outrage.

Either way, the slight de-escalation has been seen as a step in the right direction to allow much needed aid to find its way to civilians in need.

However, the potential for a broader conflict has risen since the April 1st attack on an Iranian embassy in Syria which killed senior Iranian commanders. Risk sentiment remains on edge after Iran warned of an ‘inevitable’ retaliation.

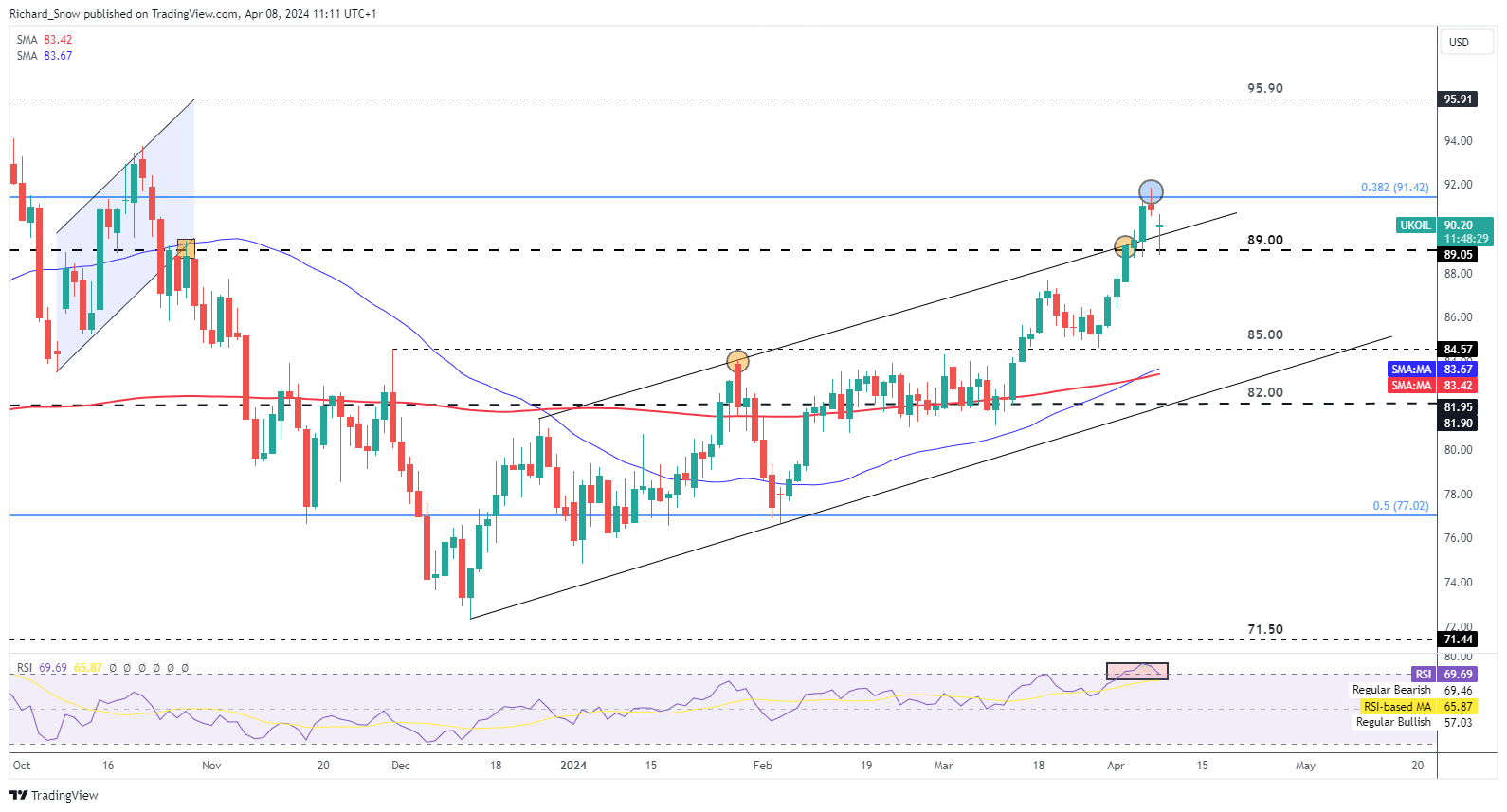

Brent crude oil broke above the longer-term ascending channel, heading well above the $90 marker, finding resistance near $91.42.

Prices

gapped lower at the start of trading week as tensions eased but stull remain elevated. A hold above the upward sloping

trendline

(former

resistance

) appears as the most immediate test for oil bulls.

Prices

dropped below $89 intra-day but have recovered from the daily low. A bullish bias remains constructive as long as prices remain above $85. However, on a more short-term basis, overbought territory on the

RSI

poses a challenge for bulls in the shorter-term. Lastly, more evidence of a pullback from here emerges via the bounce at the 38.2% retracement of the 2020-2022 major rise.

Brent Crude Daily Chart

Source: TradingView, prepared by

Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

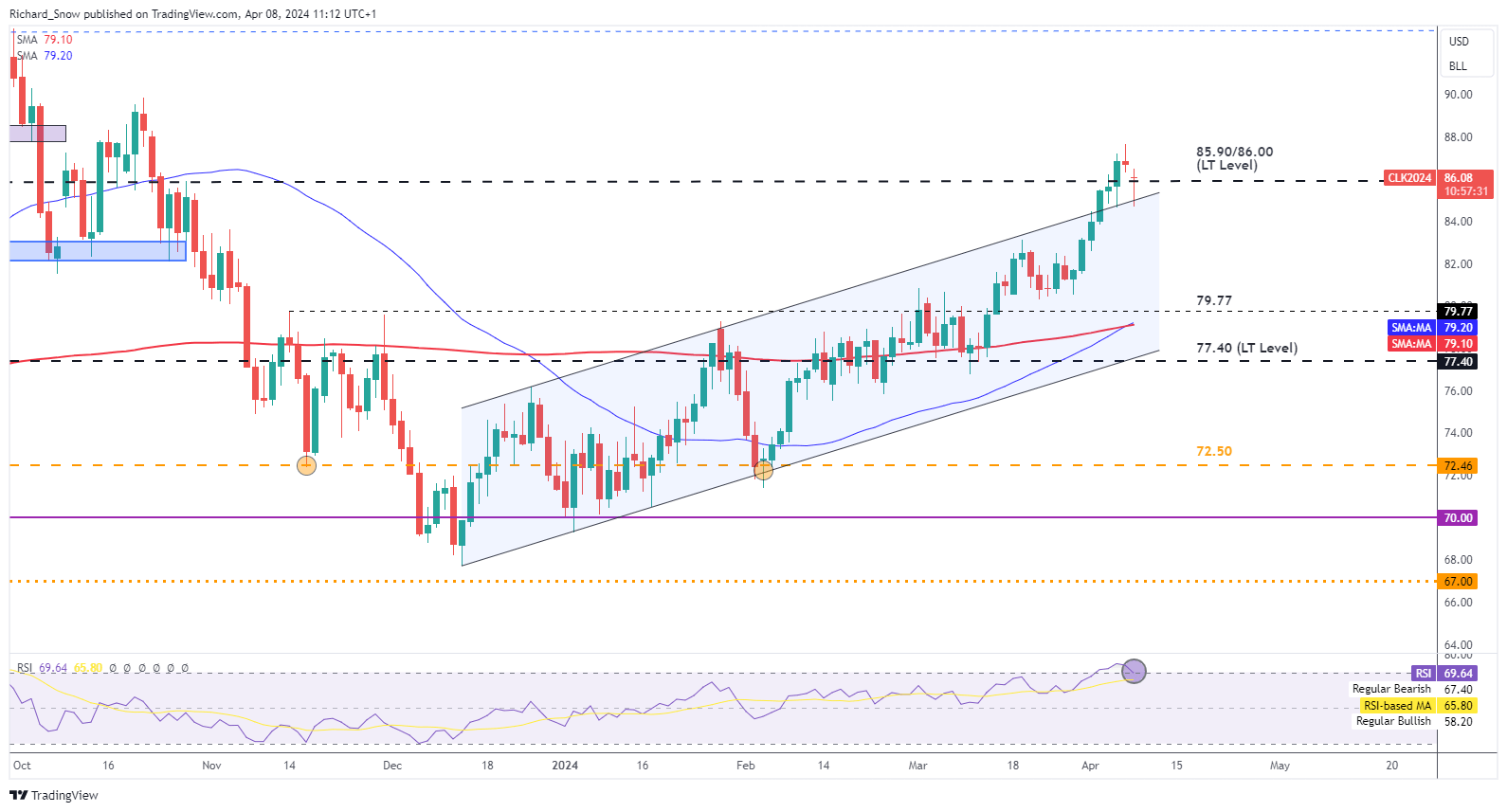

WTI trades in a similar fashion to Brent crude oil, heading lower at the start of the week after breaching into overbought territory. The move lower is already showing signs of restraint as the daily candle reveals a long lower wick but it will be important to wait for the candle close before confirming such a suspicion.

Further bearish signals would include the RSI recovering from overbought territory and a close back within the ascending channel. A bullish crossover will help bulls maintain a bullish bias but keep in mind the moving averages are inherently lagged in nature.

WTI Daily Chart

Source: TradingView, prepared by

Richard Snow

Oil (Brent, WTI) News and Analysis

Israeli Troops Pulled out of Southern of Gaza as Peace Talks Got Under Way

Brent crude oil gaps lower as tensions appear to ease at the start of the week

WTI Eyes Overbought Conditions as the Commodity Eases on Monday

Change in

Longs

Shorts

OI

Daily

-12%

-5%

-11%

Weekly

10%

13%

10%